Updated by 10.02.2024

PayFac and CBPS: The Most Cost-Effective Way to Accept Credit Cards

Digital wallets, tap-to-pay, and online banking have made it easier than ever for customers to buy things, so much so that 70% of US consumers have swapped cash for credit cards. Unfortunately, if your business doesn’t accept credit cards, you’re losing more than 200% of revenue for every ten customers.

Yet, while secure and convenient, we know credit cards can be a headache for small companies. Traditional merchant accounts are expensive to set up and maintain, and their complexities drain resources.

When processing fees start eating into tight margins, business owners face the tough choice between fewer profits or passing on the credit card processing fees to customers; neither is preferable.

Fortunately, innovative payment solutions like Payment Facilitators (PayFacs) and Consumer Bill Payment Services (CBPS) empower smaller merchants. These integrated platforms offer businesses a cost-effective and efficient way to accept card payments, equipping them to compete effectively in today’s digital marketplace.

E-Complish’s Vice President, Marc Hopkins, highlighted the benefits of payment solutions in a recent interview with global fintech platform PYMNTS recent interview with global fintech platform PYMNTS, discussing the impact these solutions can have on businesses and different industries.

As a trusted payment processing provider, E-Complish is here to guide you through PayFacs and CBPS. We’ll explain in detail what these solutions are, how they work behind the scenes, and, most importantly, how they can specifically benefit your business.

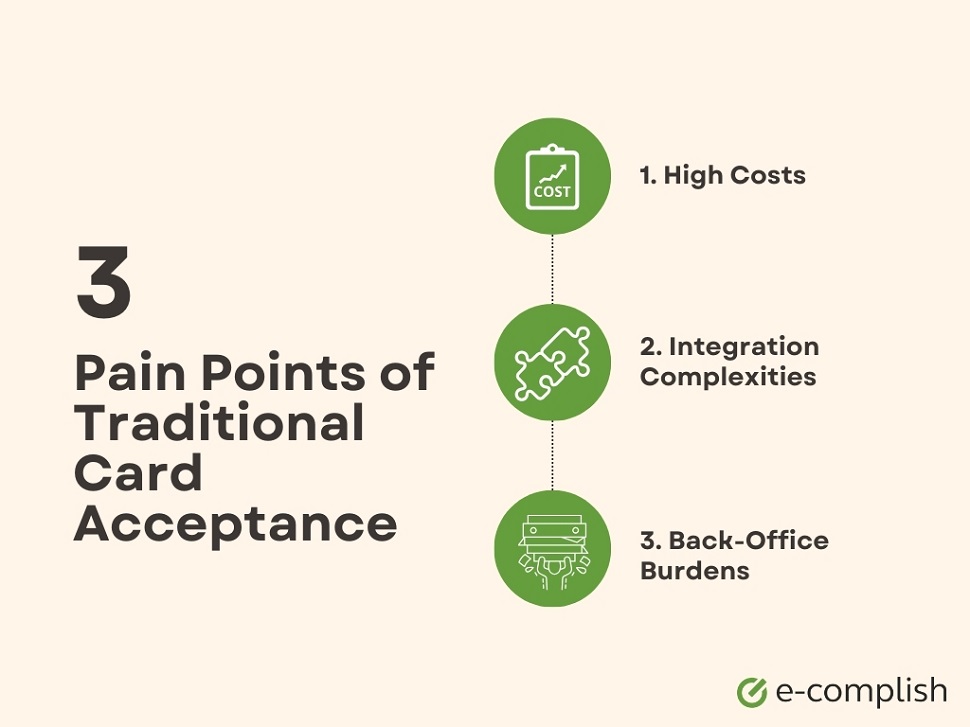

3 Pain Points of Traditional Card Acceptance

Traditional card acceptance methods have been the norm for years, but they come with their own set of challenges.

#1. High Costs

The cost of accepting credit card payments is hefty for businesses – anywhere between 1.5% to 4% per sale. Add these fees up, and they can significantly reduce your bottom line.

These fees stem from:

- Interchange Fees: Paid by the merchant’s bank to the issuing bank (bank of the customer’s card) every time a card transaction occurs.

- Processing Fees: Charged by the payment processor for handling the transaction authorization and settlement.

- Fraud Prevention Costs: Additional services like chargeback protection or fraud scoring.

#2. Integration Complexities

Adding card acceptance to a legacy billing system can be resource-intensive and time-consuming.

- Technical Hurdles: Traditional card acceptance often requires integrating with a payment processor’s system. It may involve complex APIs (application programming interfaces) and technical specifications that your IT team needs to understand and implement.

- System Compatibility: Legacy billing systems often lack secure credit card processing capabilities. Upgrading back-end systems for features like data encryption, authorization checks, and transaction reconciliation is expensive and time-consuming.

- Data Security Concerns: Additionally, your business must ensure its billing system can securely store and transmit sensitive cardholder data in compliance with industry regulations like PCI DSS.

#3. Back-Office Burdens

Lastly, card acceptance can increase your back-office workload:

- Reconciliation: Matching transactions processed by the payment gateway with internal records is time-consuming. Discrepancies must be investigated and resolved, adding to your team’s workload.

- Reporting: Generating reports for various purposes (tax, accounting, sales analysis) requires gathering data from the billing system and the payment processor. This process may involve manual manipulation and merging of data sets.

- Chargeback: When dealing with customer disputes (chargebacks), you must gather evidence and communicate with the issuing bank, which can be a complex process for the finance or customer service team.

All these back-and-forth burdens ultimately divert staff away from other core business functions.

PayFacs and CBPS: Tailored Solutions for Smaller Merchants

PayFacs and CBPS have become increasingly sophisticated in recent years, offering a wider range of features and benefits for businesses of all sizes. So, what are they, and how do they work?

PayFacs as Merchants of Record

What is a PayFac? A PayFac or payment facilitator is a third-party service that acts as a middleman between businesses (sub-merchants) and payment processors. Unlike traditional methods, PayFac becomes the record merchant for all sub-merchant transactions.

It’s responsible for:

- Processing Payments: Handling the entire transaction flow, from authorization to settlement, using its own merchant account.

- Managing Funds: Receiving and distributing customer payments to the sub-merchants, minus any applicable fees.

- Compliance: Adhering to card network rules and regulations.

Such payment facilitation services offer a convenient and efficient way for businesses to accept credit card payments, especially for those who may not qualify for a traditional merchant account or don’t want to deal with the complexities of managing it themselves.

CBPS Streamlining Bill Payments

Traditionally, paying bills involved juggling multiple envelopes, websites, and due dates. Thankfully, there’s a simpler solution: Consumer Bill Payment Services (CBPS) platforms.

Here’s how CBPS streamlines bill payments for consumers and billers, using Visa’s service as an example:

- Consolidated Convenience: CBPS allows customers to pay various bills (utilities, rent, healthcare) through a single platform.

- Card Acceptance Boost: By integrating with a CBPS platform, billers can now receive card payments from customers without needing their own merchant accounts.

CBPS offers a one-stop shop for managing and paying bills. Consumers can also replace multiple logins and due dates for convenient payment scheduling. Billers gain a wider customer base, faster settlements, and potentially lower monthly payment processing fees.

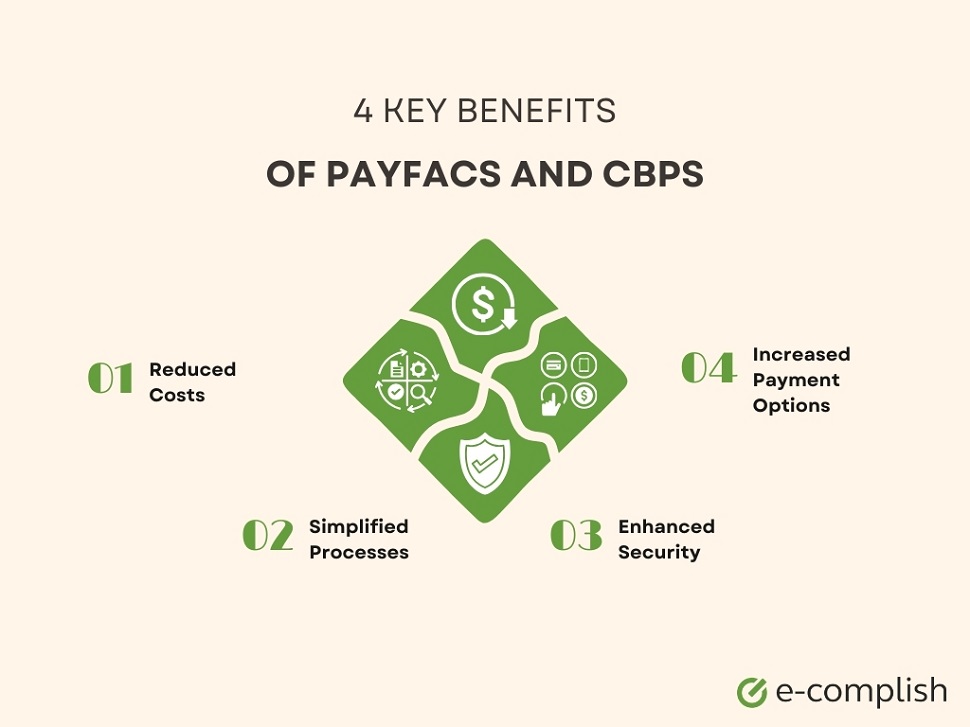

4 Key Benefits of PayFacs and CBPS: Empowering Small Businesses

Platforms like Payment Facilitators (PayFacs) and Consumer Bill Payment Services (CBPS) are revolutionizing how we pay, offering benefits such as no-fee payment processing (service/convenience fee model) and a more convenient experience for everyone involved.

#1. Reduced Costs

Unlike a single business with a limited transaction volume, PayFacs and CBPS process payments for an extensive network of sub-merchants or billers. Their aggregated volume gives them significant bargaining power to negotiate lower processing fees with payment processors. These savings trickle down to sub-merchants or billers, reducing credit card processing costs.

For example, imagine your small business processes $10,000 monthly in credit card transactions. A traditional merchant might charge a processing fee of 2.5% + $0.30 per transaction. A PayFac could reduce this to 1.5% + $0.10 per transaction, translating to $170 in savings. Some providers may even offer no-cost merchant servicing.

#2. Simplified Processes

PayFacs and CBPS make life easier for your businesses in several ways:

- Effortless Onboarding: A streamlined onboarding process with user-friendly interfaces and minimal documentation allows you to start accepting payments quickly and easily.

- All-in-One Hub: Consolidate all your payment needs into a single dashboard. Manage sub-merchants, track transactions, and access reporting tools from one central location.

- Automated Workflows: Integrated platforms automate tasks like transaction matching and reporting, saving you valuable time and effort.

- Intuitive Interfaces: Simple interfaces make it easy for anyone, regardless of technical expertise, to navigate the system and manage and accept payments efficiently.

#3. Enhanced Security

PayFacs and CBPS understand the significant financial losses businesses can face due to fraud. They implement advanced fraud detection and prevention tools to minimize the risk of fraudulent transactions.

Typically, they have a range of security features, including:

- Tokenization: Sensitive card data is replaced with unique tokens during transactions, rendering it useless if intercepted by hackers.

- Encryption: Data is scrambled in transit and at rest, adding an extra layer of protection.

- Fraud Detection Tools: Sophisticated algorithms analyze real-time transactions, flagging suspicious activity that might indicate fraud attempts.

Actively preventing fraud helps your business avoid the financial burden of chargebacks and fraudulent transactions, which translates to better cash flow and peace of mind.

#4. Increased Payment Options

While credit card acceptance is a core function, PayFacs and CBPS often accept various card brands, including Visa, Mastercard, AMEX, and Discover. Some platforms even enable integration with alternative payment methods like digital wallets (Apple Pay, Google Pay) or “buy now, pay later” services.

PayFacs and CBPS recognize the importance of catering to evolving customer preferences. By offering a more comprehensive range of payment options, these platforms enable your business to create a seamless and flexible payment experience for your customers.

Beyond Cost Savings: 3 Additional Benefits

While cost reduction is a significant advantage, integrated payment platforms like PayFacs and CBPS offer additional benefits beyond just saving money.

#1. Improved Cash Flow

PayFacs and CBPs can process funds within a few days, giving you greater financial flexibility to cover expenses, invest in growth, or simply have peace of mind with readily available capital.

Accelerating the inflow of funds can improve your business’s overall liquidity (particularly if you have a large sales volume), enabling better financial management and strategic decision-making.

#2. Enhanced Customer Experience

A smooth and convenient payment process is crucial in keeping customers happy and returning for more.

- Frictionless Payments: PayFacs and CBPS provide a streamlined and user-friendly payment experience, allowing customers to pay quickly and easily. This reduces checkout friction and frustration, leading to higher customer satisfaction.

- Multiple Payment Options: As mentioned earlier, these platforms offer a wider range of payment options, catering to diverse customer preferences and ensuring a convenient way to pay for everyone, regardless of their preferred method.

- Security and Trust: PayFacs and CBPS prioritize robust security features, giving customers confidence that their transactions are protected and encouraging repeat business.

#3. Potential for Increased On-Time Payments

Traditional bill payments are inconvenient, involving mailing checks or remembering multiple logins, whereas PayFacs and CBPS offer a one-stop shop for managing and paying bills.

Such convenience encourages customers to prioritize on-time payments. Plus, their flexibility caters to customer preferences and allows them to choose a payment method that fits their budget and timeline, potentially leading to more timely settlements.

Most platforms also offer automatic payment scheduling, which removes the risk of forgetting due dates and ensures bills are paid on time, eliminating late fees and improving business cash flow.

Choosing the Right Solution for Your Business: 5 Tips

The benefits of no-fee payment processing for your business are undeniable. But how to choose the right one for your firm?

#1. Company Size and Needs

PayFacs is ideal for startups and small businesses looking for simple onboarding and potential cost savings. CBPS benefits all businesses, but especially utility companies that use recurring billing models. Your choice between the two will depend on your company’s size, industry, and specific requirements.

#2. Budget and Fee Structures

While PayFacs and CBPS offer numerous benefits, understanding their pricing structures is crucial for determining cost-effectiveness for your business.

- Per-Transaction Fees: This model charges a fixed fee (e.g., $0.30) or a percentage (e.g., 2.5%) for each processed transaction.

- Monthly Subscription Fees: Some services have a flat monthly fee, regardless of transaction volume.

- Combination Model: Many platforms combine elements of both, with a base fee and additional per-transaction charges.

#3. Integration Capabilities

Ensure the PayFac or CBPS integrates smoothly with your existing systems (accounting, inventory) for efficient data flow. Many platforms offer APIs or plugins to simplify the integration process, minimizing disruption to your current operations.

#4. Customer Support

A PayFac or CBPS provider should be reliable and responsive in the following ways:

- Technical Assistance: Look for a provider with readily available customer support to address any technical challenges you might encounter.

- Industry Expertise: Choose a provider with knowledgeable customer support representatives who understand your industry and can answer your specific questions.

- Timely Resolutions: Downtime due to payment processing issues can be costly. Opt for a provider known for promptly and efficiently resolving customer support inquiries.

#5. Security Features

Always select merchant account providers that adhere to industry standards like PCI DSS and utilize robust encryption to safeguard sensitive information during transfers and storage. Inquire with payment service providers about their fraud prevention tools, such as tokenization and real-time transaction monitoring, to minimize the risk of fraudulent activity. Reputable providers will be transparent about their security measures and should be able to address your concerns about incident response plans and how they handle potential security breaches.

The Future of Bill Payments and Emerging Trends

The future of bill payments is all about speed, convenience, and broader accessibility, especially in the financial sector, “as loan payments get a leg up with convenient card options, in contrast to ACH transactions that typically take days,” says Marc.

Emerging trends that are fast becoming a reality include:

- Real-Time Payments: The advent of real-time payment systems like FedNow heralds a new era in bill payments. Funds will instantly appear in your account when a customer pays their bill, revolutionizing businesses’ cash flow management and enhancing their financial agility.

- Financial Services Boost: Loan repayments and other financial transactions can be streamlined, providing speed and convenience compared to traditional methods like ACH transfers. Faster transactions and convenience naturally improve customer satisfaction and potentially increase loan participation.

- CBPS on the Rise: Marc Hopkins highlights the growing importance of CBPS as e-commerce flourishes. Consumers are increasingly looking for all-in-one solutions to manage their bills. CBPS platforms offer a convenient way to pay multiple bills from a single platform. This not only benefits consumers but also simplifies bill collection for businesses.

Embracing innovative solutions like PayFacs and CBPS can better position your business for the long term in the fast-paced world of digital payments.

Embrace the Efficiency of Modern Bill Payment Solutions

PayFacs and Consumer Bill Payment Services (CBPS) are modern business solutions that streamline operations and boost customer satisfaction.

These integrated platforms reduce costs, expedite settlements, and offer enhanced security. CBPS provides a one-stop shop for billers to manage payments, while PayFacs simplifies onboarding for smaller companies.

Ready to unlock the efficiency of modern bill payment solutions? E-Complish is your trusted payment service provider. Reach out to us today to learn more about our PayFac and CBPS offerings for your business.

Table of Contents

Table of Contents