Updated by 02.06.2026

No-Cost Merchant Services: Your Gateway to Success with Visa CBPS and PayFac

In the ever-evolving landscape of the payment processing industry, businesses grapple with challenges that often feel like uncharted territory. High transaction costs, complex fee structures, and the need for seamless payment solutions have become persistent pain points.

Enter Visa CBPS (consumer bill payment service) and PayFac (payment facilitator) services – a dynamic duo revolutionizing payment processing. Below is a detailed look at what they are and how they can benefit your business.

What Are No-Cost Merchant Services?

No-cost merchant services is a payment processing model that enables merchants to accept customer credit and debit card payments without incurring the usual fees associated with traditional payment processing services, such as standard transaction fees, interchange fees, and monthly fees.

Zero-fee processing appeals to small, medium, and large-sized enterprises looking to increase profit margins and minimize overhead expenses associated with card payments. Merchant account providers usually offer free merchant processing services by passing the cost of processing fees onto customers through a convenience fee, service fee, or surcharge percentage.

Why Are No-Cost Merchant Services Important?

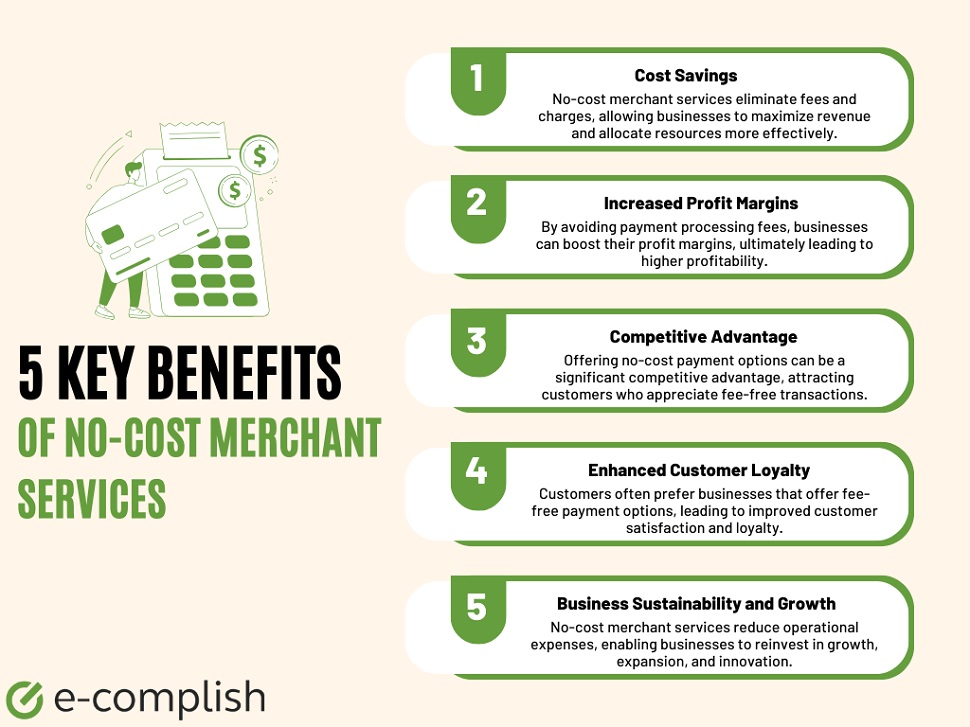

There are several reasons why free merchant services, such as no-cost debit and credit card processing, are advantageous for businesses:

- Cost savings: With no-fee merchant processing, businesses can keep more revenue, increasing profitability.

- Streamlined finances: No-cost merchant services provide a predictable and transparent fee structure, making managing cash flow and allocating resources easier. Receive 100% of the principal amount paid with no fees deducted.

- Competitive edge: By reducing credit card processing fees, you can allocate those savings to marketing, product development, innovation, or customer service enhancements.

Visa’s CBPS (Zero-Cost Debit and Credit Card Acceptance)

Overview of Visa’s CBPS Program

CBPS is a convenient way for consumers to pay their bills, utilizing their credit or debit card. The Visa Consumer Bill Payment Service (CBPS) is an optional service that provides bill payment services to consumers using debit or credit cards.

Key Features of Visa’s CBPS Program:

- Merchant on record: The CBPS provider serves as the merchant on record, processing consumer card payments on your behalf.

- No hassle onboarding: Fast start to card processing without the inconvenience of the traditional merchant service underwriting.

- PCI DSS compliant: Level 1 PCI compliant card processing.

Participating in CBPS offers businesses improved efficiency, transparency, potential cost savings, enhanced security, and a competitive advantage in payment processing.

Eligibility and Requirements

The following table briefly overviews the specific eligibility conditions and requirements.

| Eligibility and Requirements | Description |

|---|---|

| Business Type | Open to various types of businesses, including small, medium, and large-sized enterprises (SMEs), large corporations, and nonprofit organizations. |

| Industry | Typically, no restrictions on the industry. The program caters to a wide range of sectors, including Finance, Utility, healthcare, and more. |

| Compliance | Businesses must adhere to Visa’s compliance and security standards, including PCI DSS (Payment Card Industry Data Security Standard) compliance. |

| Financial Stability | A solid financial track record and stability are typically preferred, especially for larger-scale CBPS solutions. |

| Commitment to Innovation | A willingness to leverage CBPS for innovative payment solutions and a commitment to enhancing the B2B and B2C payment experience. |

| Legal and Regulatory | Compliance with local, national, and international legal and regulatory requirements is mandatory. |

Get Started with E-Complish

Contact our team today to learn more about our PayFac and consumer bill payment services, guaranteed to simplify and streamline your payment processing.

PayFac Services (Payment Facilitator)

Understanding the PayFac Model

A Payment Facilitator (PayFac) streamlines payment acceptance for multiple merchants or sub-merchants by aggregating them under one merchant account. This eliminates the need for individual merchant accounts and allows businesses to start accepting payments quickly.

PayFac handles tasks such as payment authorization, settlement, and reporting, making the payment process more accessible and efficient for businesses of all sizes. With PayFac, companies can enjoy simplified payment acceptance, rapid sub-merchant onboarding, and efficient transaction management.

This solution reduces administrative burden, provides faster access to payment processing capabilities, and enhances business scalability.

Regulatory Considerations

Understanding and complying with regulatory considerations is paramount for businesses utilizing the PayFac model. These considerations form the foundation for legal adherence, financial stability, and trust-building within the payment processing industry.

The following table offers a comprehensive overview of the key regulatory considerations:

| Regulatory Considerations | Description |

|---|---|

| Payment Industry Regulations | Compliance with payment industry regulations is essential. PayFacs must adhere to standards like PCI DSS (Payment Card Industry Data Security Standard) to protect sensitive payment data. |

| Know Your Customer (KYC) | PayFacs are required to implement robust KYC procedures to verify the identities of sub-merchants and ensure compliance with anti-money laundering (AML) laws. |

| Anti-Money Laundering (AML) | Stringent AML measures must be in place to detect and prevent illicit financial activities. PayFacs must report suspicious transactions to relevant authorities. |

| Regulatory Licensing | Depending on the jurisdiction, PayFacs may require licenses or registrations as financial service providers. Compliance with local and international regulations is crucial. |

| Risk Management | Effective risk management practices are necessary to identify and mitigate potential fraud and financial risks within the PayFac model. |

| Data Privacy and Security | PayFacs must maintain robust data privacy and security measures to safeguard sensitive customer and transaction data in compliance with data protection laws. |

| Cross-Border Transactions | Handling cross-border transactions may involve additional compliance requirements, including currency exchange regulations and international tax laws. |

| Consumer Protection Laws | Compliance with consumer protection laws is vital to ensure fair and transparent business practices, including refund policies and dispute resolution processes. |

| Reporting and Auditing | Regular reporting and auditing of financial transactions and compliance procedures are often mandated by regulatory authorities to maintain transparency and accountability. |

Adhering to these regulatory considerations is vital for businesses to sustain a trustworthy and enduring PayFac operation. It serves a dual purpose: preventing legal consequences and nurturing trust among customers and partners, which is fundamental for long-term prosperity.

As you navigate the intricate and evolving regulatory landscape, seeking guidance from legal professionals or regulatory experts during the setup and maintenance of a PayFac model is strongly recommended.

Leveraging Visa CBPS and PayFac Services

Here are some of the specific benefits:

- Streamlined onboarding of sub-merchants, which is beneficial for businesses with many sub-merchants.

- Enhanced payment efficiency because Visa CBPS and PayFac services offer a variety of features and tools to help businesses manage and accept credit cards and debit cards, such as automated reconciliation, disbursement and next-day funding, etc.

- Reduced operational costs due to competitive rates and services that save money on payment processing fees.

Overall, Visa CBPS and PayFac services offer a seamless payment processing solution to streamline sub-merchant onboarding, enhance payment efficiency, and reduce operational costs.

Unlock the Full Potential of Payment Solutions with E-Complish

CBPS and PayFac services offer a significant cost-saving opportunity for businesses, enabling them to optimize their payment processing operations and improve their profitability. Businesses are encouraged to explore zero-fee merchant processing further and consider how they can integrate them into their operations.

As part of E-Complish’s PayFac and CBPS services, we manage KYC requirements, anti-money laundering regulations, underwriting procedures, and application processing, eliminating payment processing stress.

Contact us today to reap the benefits of our CBPS and PayFac’s fraud protection tools, chargeback management services, and future-forward software.

FAQ

What types of businesses can benefit from these services?

Is switching to Visa CBPS and PayFac services possible if we use a different payment processing solution?

Can PayFac and CBPS services handle high transaction volumes?

Table of Contents

Table of Contents