Updated by 02.07.2025

RTP vs. ACH: A Guide to the Right Payment Method for Your Business

High-speed internet, a growing appetite for instant gratification and convenience permeating consumerism, and government reforms are changing how we pay and get paid. The shift from hard cash to cashless economies completely redefines the customer experience and enables businesses of all sizes to streamline operations across industries.

Recent studies suggest that 85% of businesses and 78% of consumers already utilize faster payment options, and over 65% indicate they plan to increase their use of immediate payments by 2026. Real-Time Payments (RTP) and Automated Clearing House (ACH) are the best options for most.

While both excel at speed and efficiency, there’s no one-size-fits-all solution. The optimal choice in payment solutions depends on what matters most to your unique business operations and workflow. Let’s explore the nuances of each to help you make an informed decision.

What Are ACH Payments?

Automated Clearing House (ACH) is a U.S. financial network that enables electronic payments and money transfers from one bank to another without paper checks, credit card networks, wire transfers, or cash.

ACH transfers have been a popular, fast, and secure payment option since the 1970s because of the following benefits:

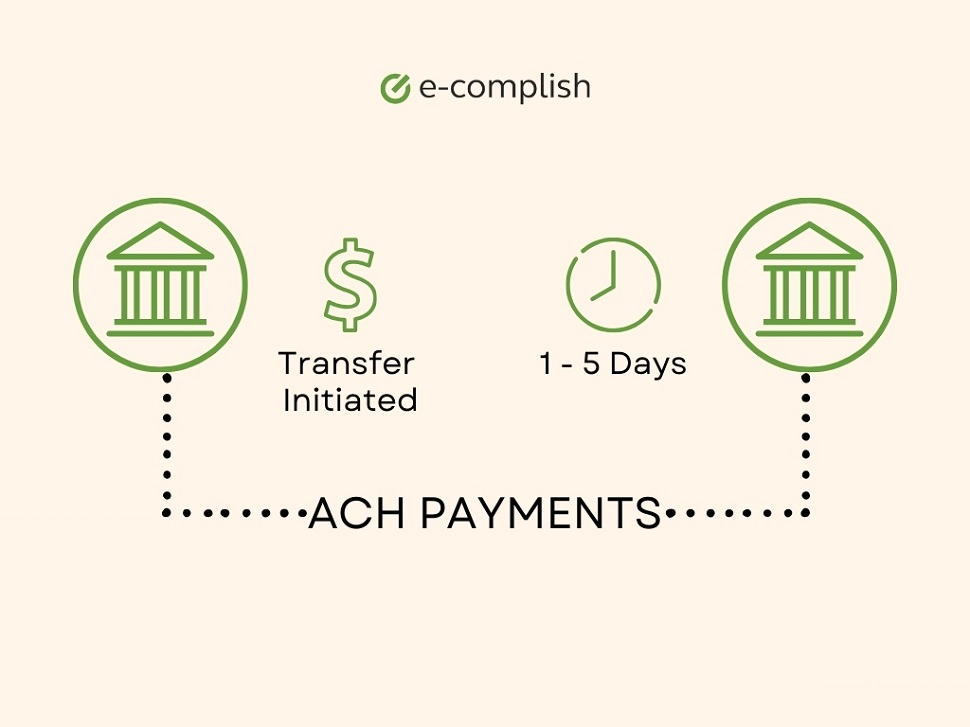

- Batch processing: ACH transactions are batched and processed throughout the day. Same-day ACH payments are possible, but settlements typically occur within 1-3 business days. A batching system allows cost-effective processing and is ideal for high-volume, low-value transactions.

- Cost-effectiveness: Compared to payment methods like wire transfers, ACH transactions generally carry lower processing fees, making it a budget-friendly option for businesses, especially for recurring payments like subscriptions or payroll.

- Wide acceptance: ACH enjoys extensive adoption by financial institutions in the U.S. This ensures a high level of compatibility for both senders and receivers, minimizing the risk of failed transactions due to network incompatibility.

ACH payments are beneficial in a variety of scenarios:

- Recurring payments: ACH excels at automated, on-time payments from gym memberships to subscription boxes.

- Payroll: Many businesses utilize ACH for efficient and secure employee salary disbursements.

- Bill payments: Utility companies, internet providers, and other service providers often accept ACH payments to settle customer bills.

With its speed, affordability, and broad acceptance, ACH has become a cornerstone of electronic payments in the U.S., with 78% of organizations using it for credit and debit transactions.

What Are Real-Time Payments (RTP)?

The Clearing House launched the RTP Network in 2017, making it the newest electronic bank payment method available in the United States.

Real-time payments have been a game-changer for businesses and consumers for the following reasons:

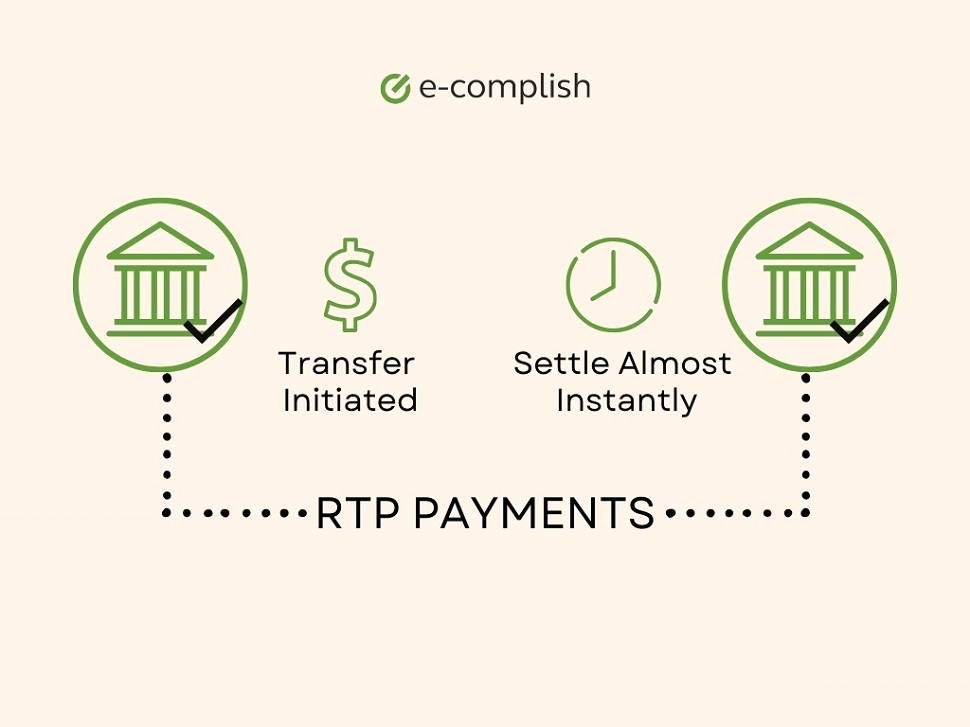

- Instantaneous settlements: A real-time payment delivers funds directly to the recipient’s bank account within seconds, mimicking the speed of cash transactions. This eliminates the float associated with ACH, improving businesses’ cash flow.

- 24/7/365 availability: Unlike traditional methods restricted by banking hours, RTP operates around the clock every day of the year. This provides unmatched flexibility for businesses and individuals, allowing instant payments anytime, anywhere.

- Enhanced security: RTP incorporates robust security measures to protect sensitive financial information. These include strong encryption and real-time transaction verification, mitigating the risk of fraud.

- More than just money: RTP goes beyond just transferring funds. It allows for the inclusion of payment confirmation and messaging capabilities. Businesses can send invoices and other relevant information alongside the payment, streamlining communication and record-keeping.

Ideal use cases for RTP include:

- Instant payouts: Need to provide immediate payouts to contractors, freelancers, or gig workers? RTP offers a secure and instant solution.

- Emergency disbursements: In times of need, RTP can be used to provide immediate financial assistance, such as disaster relief or insurance payouts.

- Time-sensitive transactions: For transactions requiring immediate settlement, like same-day purchases or on-demand services, RTP eliminates delays, ensuring instant completion.

Real-Time Payments vs ACH Payments: Which One to Choose for Your Business

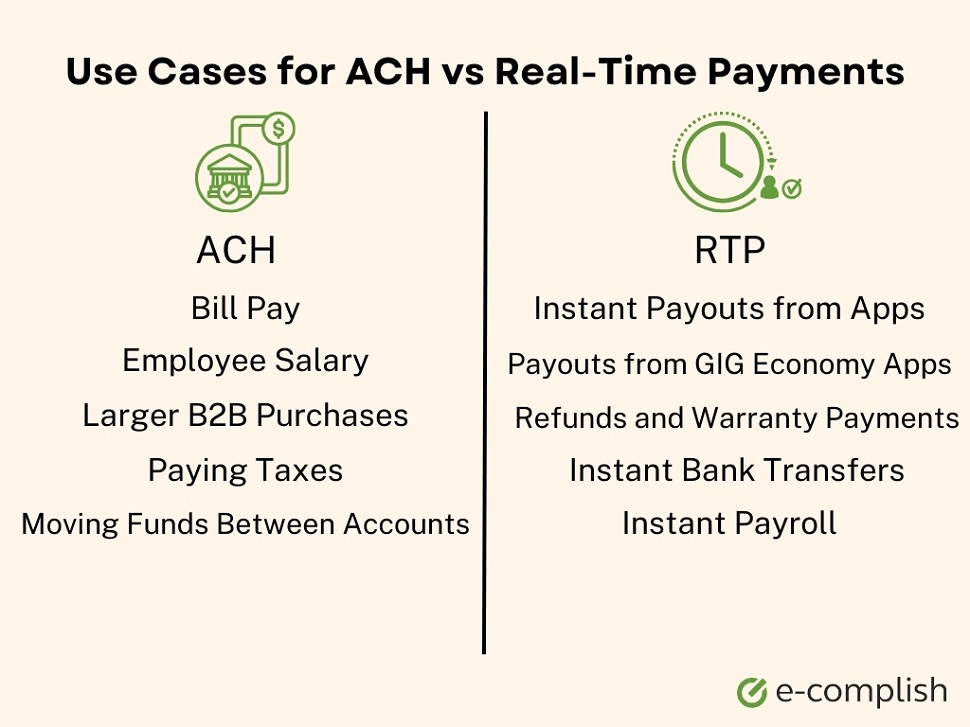

ACH excels at handling batched transfers, which is ideal for recurring payments. RTPs, on the other hand, prioritize real-time delivery, which is perfect for instant contractor payouts. Both options offer unique benefits for your business.

| FEATURE | ACH | RTP |

|---|---|---|

| Processing Speed | Transactions are batched and typically clear in 1-3 business days | Funds are transferred and available instantly to the recipient’s account |

| Cost | Generally lower transaction fees | May have higher fees compared to ACH |

| Availability | Available during business hours on weekdays | Available 24/7/365 |

| Transaction Limits | Higher transaction limits (often exceeding $100,000) | May have lower transaction limits compared to ACH |

| Security Features | Employs robust security measures | Employs real-time transaction verification and strong encryption |

| Ideal Use Cases | Recurring payments, payroll, and bill payments | Instant payouts, emergency disbursements, time-sensitive transactions (e.g., same-day deliveries) |

| Additional Considerations | Wide network acceptance | Relatively new technology, not all banks may offer instant availability |

There are also other considerations, such as:

- Transaction volume: High-volume, low-value transactions like recurring subscriptions or payroll are well-suited for ACH’s cost-effectiveness. Batch processing allows for efficient handling of large numbers of transactions.

- Speed requirements: Are immediate settlements crucial? Look no further than RTP for gig economy payouts, same-day deliveries, or emergency disbursements.

- Budget: Consider your transaction fee tolerance. While ACH generally boasts lower fees, RTP’s higher per-transaction cost can be justified when speed is paramount.

- Industry: Certain industries naturally gravitate towards specific methods. On-demand services, ride-sharing platforms, and marketplaces with instant payouts find RTP’s speed invaluable. Conversely, subscription services, utility companies, and payroll processing companies can leverage ACH’s cost-efficiency for regular payments.

RTP Payments vs. ACH vs. Wires

While Real-Time Payments (RTP) and Automated Clearing House (ACH) networks have emerged as popular electronic transfer options, traditional wire transfers are still relevant.

Wire transfers involve sending funds electronically through a secure network between two banks. Unlike RTP and ACH, which utilize batch processing, wire transfers process each payment individually.

Although painstaking, funds are often available within the same day (domestic) or a few days (international). However, wire transfers are more expensive.

Wireless offers a secure and reliable option for large, high-value transactions (think real estate purchases or international payments). Additionally, some scenarios, like sending money abroad where RTP or ACH might not be supported, necessitate wire transfers.

So, where do RTP and ACH excel?

Both offer significant advantages over wire transfers. As previously mentioned, RTP prioritizes speed, instantly delivering funds to the recipient’s account, similar to cash. An ideal situation for instant payouts or time-sensitive transactions.

ACH, on the other hand, is known for its cost-effectiveness. While funds take 1-3 business days to clear, ACH is perfect for recurring payments, payroll, and other scenarios where speed isn’t a major concern.

Ultimately, the choice between RTP, ACH, and wire transfers depends on your needs. Wire transfers are safer than mailing a check, but RTP and ACH are superior in terms of speed.

Benefits of Using E-Complish for ACH Payments

With over 25 years of experience and a 98% customer retention rate, E-Complish stands out as a leading provider of payment processing solutions. When you require the cost-effective reliability of Automated Clearing House (ACH) networks, E-Complish offers a comprehensive suite of services to meet your specific needs. E-Complish RTP/FedNow coming soon!

Seamless Integration for a Frictionless Experience

Our solutions are designed for smooth compatibility with popular systems like Priority, Paysafe, and others. Our DevConnect product offers a single API for developers to effortlessly integrate their legacy systems with our ACH and credit card processors. Simply collect payment information through your current system and easily submit it to E-Complish for instant authorization.

Security and Compliance at the Forefront

Managing payments can be a hassle, especially with regulations like PCI Compliance adding complexity. E-Complish is a NACHA and Level 1 PCI Compliant partner, meaning we handle all the security headaches for you, ensuring your transactions and data are always protected.

Streamline Your Processes, Boost Efficiency

We offer streamlined solutions that automate manual tasks, reduce errors, and improve efficiency. Our efficiencies translate into valuable time savings and a smoother workflow, allowing you to dedicate more resources to growing your business.

Expert Support Every Step of the Way

E-Complish understands that navigating the world of payments can be complex. That’s why we offer comprehensive expert support and guidance every step of the way. From understanding the benefits of RTP and ACH to choosing the right solution for your business, our dedicated team is here to answer your questions and ensure a successful implementation, providing you with the confidence and peace of mind you need.

Find Your Perfect Payment Solution with E-Complish!

Navigating the world of electronic payments can be confusing, especially when faced with choices like Real-Time Payments (RTP) and Automated Clearing House (ACH). When weighing up the pros and cons, consider factors like transaction volume, budget constraints, industry demands, and the importance of speed in your operations.

Our team of experts can guide you through the intricacies of ACH, providing a comprehensive consultation to understand your business needs and recommend the most suitable option. You don’t navigate the world of payment processing alone.

Ask our specialists to help you choose the payment service that propels your business forward!

Table of Contents

Table of Contents