Table of Contents

Updated by 10.02.2024

SMS Mobile Payment Solutions: A Comprehensive Guide

SMS mobile payments are quickly becoming a preferred method for mobile transactions, riding the wave of widespread smartphone adoption and the growing appetite for convenient online shopping. Recent data shows that 46% of U.S. consumers – a staggering 114 million adults – have embraced mobile payments.

Businesses seeking to optimize their payment processes and meet customer expectations utilize E-Complish’s Text2Pay, a simple yet powerful solution that streamlines recurring payments and allows a broader demographic to access SMS text payment solutions. Let’s unpack what an SMS mobile payment system can do for your organization.

What Are SMS Payments?

SMS (Short Messaging Service) payments, or text-to-pay, enable customers to pay your business using a text message. All financial transactions are initiated and completed simply by sending a text message to a designated phone number.

The process involves the user texting a keyword, amount, or other payment details to trigger the transaction. For example, a customer might text “PAY $25” to your SMS payment number to make a purchase. SMS mobile payments are securely processed in the background without entering payment information or navigating a mobile app.

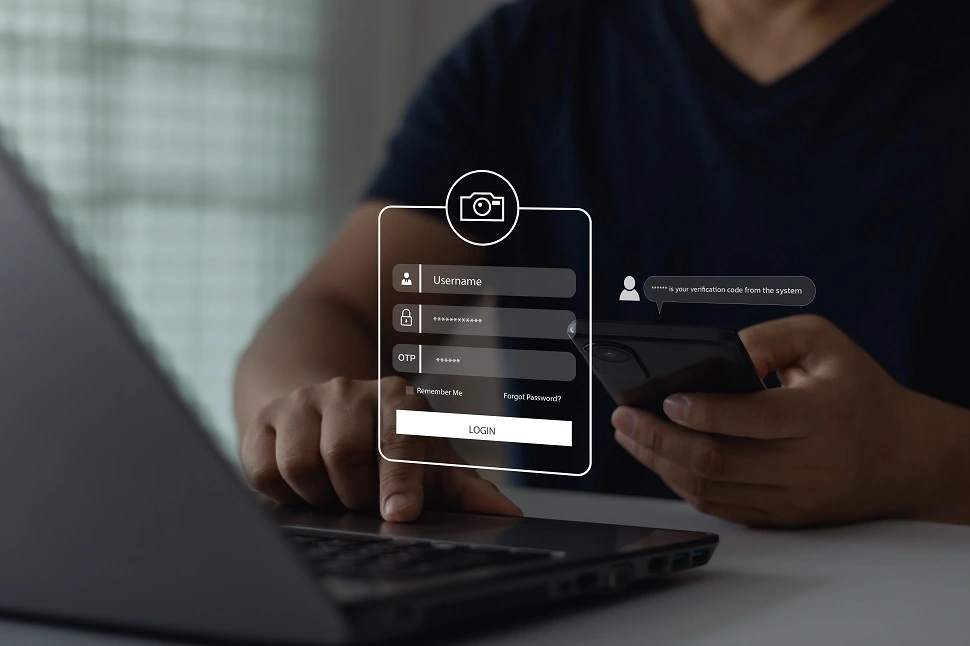

How Do Pay via SMS Work

SMS mobile payments are a simple, straightforward process:

- Initiating the payment: Customers sign up for E-Complish Text2Pay and choose whether to pay bills directly or receive payment reminders. For those opting to pay directly, payment account information is securely stored in our system, and a personalized PIN is created for verification. When a bill is due, Text2Pay sends a text payment notification to the customer.

- Verification and security: Upon receiving the SMS payment message, customers can initiate the transaction by texting a specific keyword, dollar amount, or other relevant payment details to a designated phone number. The system verifies the customer’s identity using their personalized PIN, which they submit to authorize the payment.

- Confirmation: After completing the transaction, the customer receives an SMS confirmation, providing a payment record that includes details such as the amount, date, and merchant information.

This workflow allows customers to make payments any time, day or night, without the need to manually enter card details or navigate mobile apps. The entire process is designed to be quick, easy, and seamless, requiring minimal effort for on-the-go financial transactions.

Ready to Accept SMS payments and Reach a Wider Customer Base?

We know how to help! Get a demo and make your payments easier!

Benefits of SMS Payments for Both Parties

Let’s take a closer look at how the sms mobile payment system can benefit all parties involved.

Pros of SMS Payment Solution for Businesses

SMS payment solutions offer businesses a versatile and accessible method for conducting financial transactions in today’s mobile-first marketplace.

- Increased reach and customer base: SMS payments tap into previously underserved markets, including rural populations who may not have access to traditional banking services but do own mobile phones.

- Improved customer experience: This technology enables quick and convenient transactions, allowing customers to make payments anytime, anywhere, without needing cash or cards.

- Reduced transaction costs: SMS payments come with lower fees and operational costs compared to traditional payment methods like credit card processing or cash handling.

- Enhanced security: SMS mobile payments utilize mobile authentication and encryption methods, adding an extra layer of security to transactions and reducing the risk of fraud compared to physical payment options.

- Improved data collection: Digitized transactions help businesses gather valuable customer data and purchasing patterns, enabling more targeted marketing strategies and improved inventory management.

Pros of SMS Payment Solution for Consumers

This user-friendly technology taps into the device consumers always have on hand – their phones.

- Convenience and accessibility: Users can transact using their mobile phones anytime, anywhere. This benefit is particularly valuable for those with limited access to traditional banking services or those living in areas with sparse financial infrastructure.

- Reduced reliance on credit cards and physical cash: By adopting SMS payments, consumers decrease their dependence on physical payment methods. It minimizes risks associated with carrying cash and eliminates the need to remember multiple credit card details.

- Secure and reliable: SMS payment systems incorporate encryption and two-factor authentication. These features provide peace of mind by protecting financial information against unauthorized access and fraud.

- Faster and easier: With pre-stored secure information, transactions require no login or personal data entry. Users can complete payments quickly with just a few taps on their phone, eliminating the need for passwords or usernames.

By embracing SMS payment solutions, businesses can stay competitive and responsive to consumer needs while consumers can enjoy greater financial empowerment and convenience.

How to Implement SMS Payments in Your Business

Implementing SMS payments is a straightforward process designed to revolutionize your business’s transaction handling if you choose a provider that’s easy to work with and offers robust security.

Choosing the Right SMS Payment Provider

Selecting the right SMS payment provider is crucial for successfully implementing text-based transactions.

- Security and compliance: Choose a provider adhering to industry standards like PCI DSS. Look for robust data encryption, secure authentication methods, and comprehensive safeguards for financial information.

- Integration options: Assess how easily the provider’s solution integrates with your existing POS, CRM, and website systems. This almost guarantees smoother implementation and minimizes technical challenges.

- Fee structure: Opt for providers with transparent pricing models. Understand different fee structures, including transaction fees and monthly costs, to avoid unexpected expenses.

- Customer support: Prioritize providers offering reliable, readily available support, which is invaluable during integration, troubleshooting, and ongoing guidance.

- Features: Evaluate additional offerings such as mobile wallet support, international payment capabilities, and fraud prevention tools.

Integration Process of SMS Payments

Text2Pay from E-Complish is a tool perfect for any business or industry, and it’s so easy to get started:

- Sign up and setup: Simply create an account on our platform, providing basic business information and necessary documentation for verification.

- API integration: We utilize API payment technology to connect our SMS payment gateway with your existing systems seamlessly. API (Application Programming Interface) acts as a bridge, allowing different software systems to communicate and share data securely. This enables real-time transaction processing and data exchange without disrupting your current workflows, making integration efficient and user-friendly.

- Configure payment options: Customize your payment ecosystem by selecting from our range of supported payment methods. Set transaction limits and choose which mobile money wallets to accept, tailoring the experience to your customer’s preferences.

- Testing and go-live: We provide a sandbox environment for thorough testing before launch. This identifies and resolves any potential issues, ensuring a flawless experience when you go live with SMS mobile payments.

Security Payment Process Considerations

At E-Complish, we secure your payments by incorporating state-of-the-art security measures, such as:

- Data encryption: 256-bit AES encryption for all data transmissions. This military-grade protection ensures your customers’ sensitive information remains secure throughout the payment process.

- Authentication and verification: Our system employs robust two-factor authentication (2FA) for every transaction. Customers use their unique PIN combined with a time-sensitive one-time password sent via SMS.

- Fraud prevention tools: E-Complish’s advanced machine-learning algorithms work tirelessly to prevent fraud. Our system analyzes transaction patterns in real time, instantly flagging suspicious activities. We also provide customizable alert settings for transactions exceeding your specified thresholds.

Strict PCI DSS compliance and regular security audits keep our SMS payment system at the forefront of payment security. With E-Complish, you can trust that your business and customers are protected by industry-leading security measures.

E-Complish SMS Payment System Advantages

Mobile payment via SMS provides various advantages for merchants of all sizes.

- Seamless integration: Our Text2Ppay platform is built with versatility in mind. We offer smooth integration with many existing systems, including popular e-commerce platforms, point-of-sale systems, and customer relationship management tools. This means you can implement our solution without disrupting your current operations, ensuring a hassle-free transition to more efficient payment processing.

- Flexible solutions: We understand that every business is unique. That’s why our SMS payment system is highly adaptable, catering to diverse industry needs, and scalable for businesses of all sizes. Whether you’re a small startup or a large corporation, we offer customizable features tailored to your requirements, ensuring our solution grows with your business.

- Cost-effectiveness: E-Complish believes in providing value without breaking the bank. Our competitive pricing structure and transparent fee model offer top-tier SMS payment capabilities without excessive costs. We eliminate hidden charges and offer tiered pricing options, allowing you to choose a plan that aligns perfectly with your budget and transaction volume.

- Enhanced security: Our SMS mobile payment system incorporates state-of-the-art security protocols, including end-to-end encryption, two-factor authentication, and real-time fraud detection. We adhere to the highest industry standards, including PCI DSS compliance, ensuring that your business and customer data remain always protected.

By choosing E-Complish’s Tex2Pay, you’re not just adopting a payment solution – you’re embracing a pathway to streamlined operations, increased customer satisfaction, and accelerated business growth. Experience the E-Complish difference today!

E-Complish SMS Payment Solutions: Streamlining Your Business!

As a leading SMS payment provider, we make it easy for businesses of all types — from property management companies and utility providers to healthcare clinics and educational institutions — to simplify their billing processes and improve cash flow. Text2Pay keeps your business and customers secure and lets them pay invoices anytime. Simple as that.

Reach out to our team or call us at +18888477744 to get this service for your business and customers.

Table of Contents