Updated by 12.29.2025

What Are Embedded Payments?

Modern commerce demands speed, convenience, and frictionless experiences for customers. As businesses compete for customer attention, how payments are processed has become a differentiator. Enter embedded payments — a transformation in payment solutions that’s reshaping how companies and consumers interact with financial services.

What Is an Embedded Payment?

Embedded payments integrate payment processing capabilities directly within a software platform, application, or website. Rather than redirecting customers to external payment gateways or third-party payment gateway services, transactions occur seamlessly within the user’s current environment.

This approach differs from traditional payment methods, where users must leave their current platform, visit a separate payment portal, and then return to complete their transaction. Embedded payments eliminate this friction.

Embedded vs. Integrated Payments

While these terms are often used interchangeably, they are distinct. Understanding the differences of these payment processing methods helps businesses choose the right solution for their needs.

| Feature | Integrated Payments | Embedded Payments |

|---|---|---|

| Payment Processing | Connects to external payment systems | Built directly into the platform |

| User Experience | May redirect to third-party pages | Seamless, no redirects |

| Branding | Often shows payment provider branding | Maintains your brand throughout |

| Integration Level | Surface-level connection | Deep, native integration |

| Setup Complexity | Moderate | More complex initially |

| Customization | Limited options | Highly customizable |

| Control | Shared with payment provider | Full control over experience |

| Revenue Potential | Standard processing fees | Additional revenue streams possible |

Both solutions aim to streamline payment processing, but embedded payments are more seamless as the payment process is virtually invisible to users. While integrated payments connect your platform to external processors, embedded payments weave payment capabilities so deeply into your system that customers never encounter third-party branding or jarring transitions.

How Embedded Payment Processing Works

At their core, embedded financial solutions rely on sophisticated technology infrastructure that connects businesses with payment service providers, financial institutions, and payment networks.

The process typically involves:

- API integration: Application programming interfaces allow platforms to communicate with payment processors seamlessly. These APIs handle everything from payment authorization to settlement, all behind the scenes.

- Payment tokenization: Customer payment information gets converted into secure tokens, protecting sensitive data while enabling smooth transactions. This encryption guarantees that businesses never handle raw card data directly.

- Real-time processing: Modern embedded payments technology processes transactions instantly, providing immediate confirmation to both merchants and customers.

- Multi-payment support: Today’s embedded solutions accommodate various payment options, including debit and credit cards, digital wallets like Apple Pay, ACH transfers, and more.

Unlike traditional models where platforms must become licensed payment facilitators themselves — a process involving significant regulatory overhead — most businesses now partner with established payment providers. These partnerships offer companies full payment capabilities without the burden of maintaining complex financial infrastructure.

Transform Your Payment Experience!

Connect with E-Complish today to discover how our embedded payment solutions can help your business increase conversions, enhance customer satisfaction, and drive revenue growth.

Benefits of Embedded Payments

The shift toward embedded financial services delivers compelling advantages for businesses across industries.

Enhanced Customer Experience and Increased Conversions

Simply put, friction kills conversions. Embedded payment processing creates seamless checkout experiences that keep users engaged and dramatically improve customer satisfaction. Research shows that eliminating redirects to external payment gateways can reduce cart abandonment significantly and boost overall sales.

New Revenue Streams and Additional Revenue

Transaction fees from payment processing create entirely new revenue streams for platforms and service providers. Beyond basic transaction fees, businesses can generate revenue through value-added services like expedited payments, installment plans, and cross-border transactions, resulting in substantial increases in customer lifetime value.

Operational Efficiency and Data Insights

Consolidating payment processing within your existing platform streamlines business operations and eliminates the need to juggle multiple vendors. Access to rich transaction data provides insights into customer behavior, purchasing patterns, and preferences, allowing for data-driven decisions about pricing, personalization, and product development.

Improved Security and Global Reach

Modern embedded payments incorporate advanced security features, including tokenization, encryption, and fraud detection algorithms. Support for multiple currencies and payment methods makes it easier to expand globally without building separate infrastructure for each region.

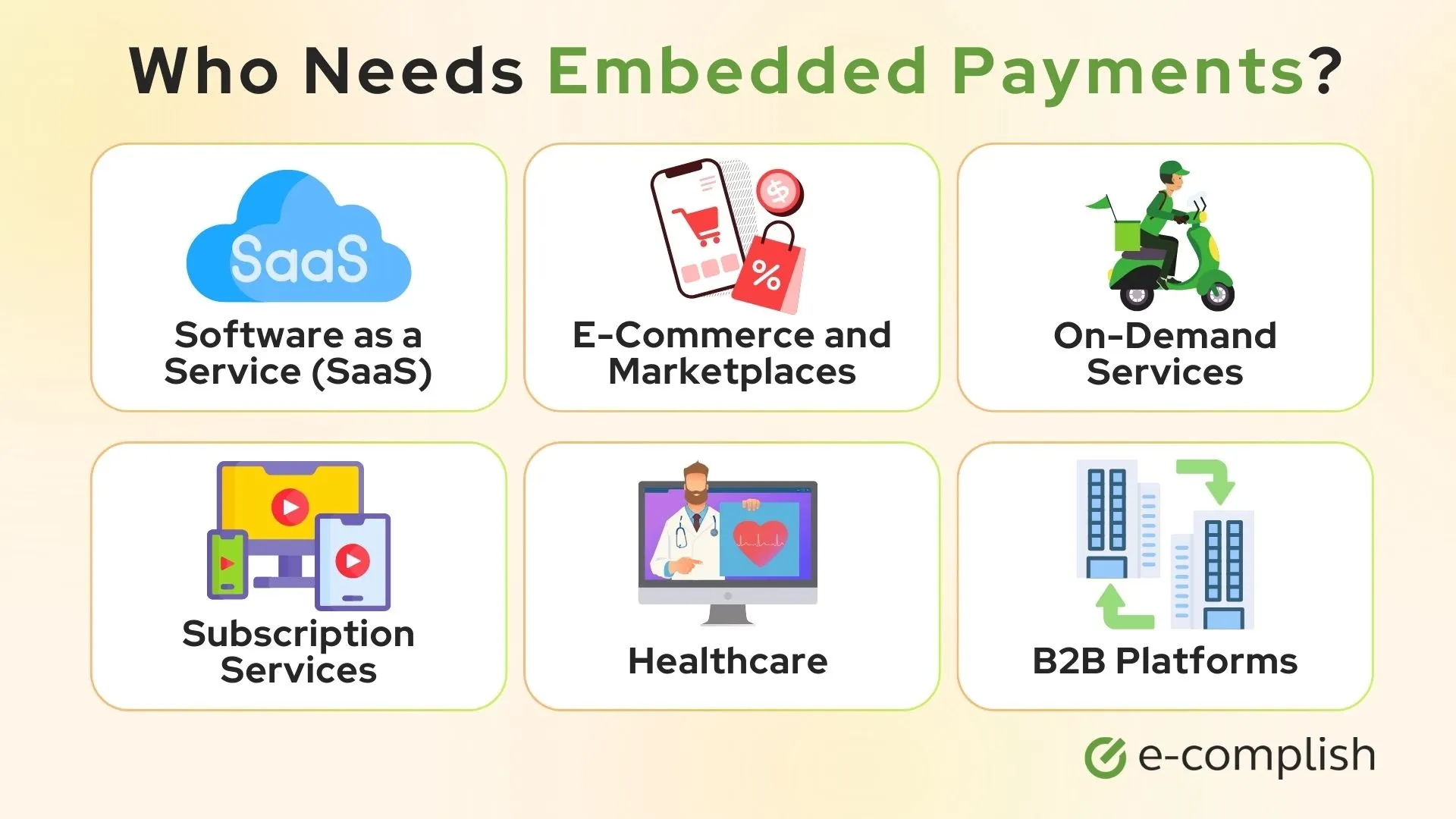

Common Use Cases for Embedded Payments

Embedded financial solutions have found applications across virtually every sector of the economy. We’ve outlined some common examples.

- Software as a service (SaaS): Independent software vendors increasingly offer payment acceptance directly to their customers. A veterinary practice management system, for example, might include embedded payment processing, allowing clinics to charge clients without switching to separate systems.

- E-commerce and marketplaces: Online marketplaces integrate embedded payments to facilitate transactions between buyers and sellers seamlessly. The one-click purchase experience pioneered by major retailers relies on embedded payment technology.

- On-demand services: Ride-sharing apps, food delivery platforms, and other on-demand services depend on embedded payments for their business model to function. These platforms process millions of transactions daily, all happening automatically within the app.

- Subscription services: Streaming platforms, software subscriptions, and membership sites use embedded payments to automate recurring billing. This automation reduces churn and improves revenue predictability.

- Healthcare: Medical practices and healthcare platforms implement embedded payments to streamline billing for services. Patients can pay balances and handle copayments without leaving the patient portal.

- B2B platforms: Business-to-business platforms offering embedded solutions help companies manage supplier payments, employee reimbursements, and client invoicing within their existing workflow tools.

Common Challenges in Deploying Embedded Payments

While it’s clear that the benefits are substantial, implementing embedded payment capabilities comes with considerations that businesses must address carefully.

Technical Integration and Compliance

Integrating payment processing into existing platforms requires technical expertise and resources. Choosing the right payment processor is critical — your provider should offer robust documentation, responsive technical support, and proven reliability.

Additionally, businesses must address complex regulatory requirements, such as data privacy laws, consumer protection regulations, and financial compliance standards.

Security and Operational Risk

To remain secure, companies must implement the proper protocols, including secure credential storage, regular security audits, and fraud monitoring. Payment system failures directly impact your core business, making redundancy, system health monitoring, and backup plans essential for effective operational risk management.

Cost Considerations and Build vs. Partner Decisions

Implementation requires investment in integration costs, ongoing transaction fees, and potential infrastructure expenses. Companies must decide whether to build payment infrastructure internally or partner with payment technology providers. Most businesses find that partnering with established payment service providers delivers better results with lower risk, as these providers have already solved complex problems around security, compliance, and reliability.

The Role of Payment Service Providers

Payment service providers help bridge the gap between platforms and the complex financial ecosystem. These companies offer the technology, licenses, and expertise needed to process payments effectively.

Quality payment providers offer:

- Comprehensive payment options: Support for card-present and card-not-present transactions, digital wallets, ACH, wire transfers, and emerging payment methods.

- Global reach: Ability to process transactions in multiple currencies across international markets.

- Security infrastructure: Advanced fraud detection, PCI compliance, and data protection.

- Reliable uptime: Redundant systems ensure payment processing continues even during system issues.

- Developer resources: Well-documented APIs, testing environments, and technical support.

- Transparent pricing: Clear fee structures without hidden charges.

- Reporting tools: Detailed analytics and transaction reporting.

Are you looking for a reliable payment service provider? E-Complish exemplifies this approach, providing businesses with the embedded solutions they need to accept payments seamlessly while maintaining the highest standards of security and service.

E-Complish: Your Next Step in Payment Innovation

Today’s businesses that thrive recognize payments not as a technical requirement but as an integral part of the customer experience. Embedded payments eliminate friction, boost conversions, and create opportunities for sustainable growth, ultimately transforming how you serve customers while unlocking new revenue potential for your company. E-Complish has 25 years of experience and 98% customer retention year over year; if you’re looking for an expert partner to streamline your operations, you’re in the right place.

Contact us today to discover how our embedded payment solutions can help you increase conversions, enhance customer satisfaction, and drive revenue growth for your business.

Table of Contents

Table of Contents