Updated by 11.28.2024

What Is Buy Now Pay Later (BNPL) & How It Works

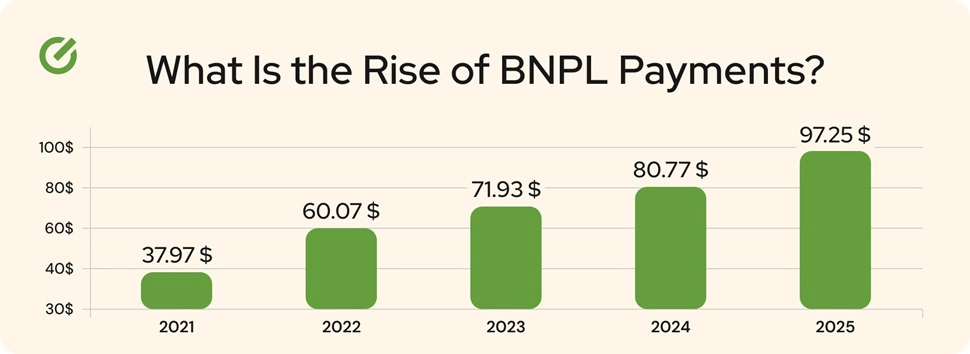

E-Commerce, coupled with Gen Z’s growing purchasing power, has accelerated the growth of BNPL (buy now, pay later) services. As digital-native consumers look to flexible payment options for online shopping, BNPL has become increasingly popular.

- 17% of consumers with credit histories have utilized BNPL services for at least one purchase, which is almost one out of five of your customers.

- 70% of people claim they spend more than initially planned when using BPNL, indicating significant upselling and cross-selling opportunities.

For most shoppers, BPNL offers compelling options – for some, even better than credit cards – that align with their evolving consumer preferences and complement existing mobile payment solutions. By the end of this post, you’ll have a comprehensive overview of BNPL and insights to help you make informed decisions about its use or implementation.

What Is BNPL?

BNPL (Buy Now Pay Later) is a short-term financing option that allows consumers to make purchases and split costs into smaller, more manageable installments. Instead of paying the total amount upfront or relying on traditional credit cards, BNPL lets shoppers spread payments over weeks or months, often without interest if paid on time.

The BNPL market is projected to grow at a compound annual growth rate (CAGR) of 25.3%, with revenues expected to reach as high as $565.8 billion by 2026, and for good reason. First and foremost, BNPL services are seamlessly integrated into online and in-store checkout processes, making it a super accessible and convenient payment option. Shoppers can approve their BNPL plan and complete mobile payments within seconds.

Another driver is affordability. By dividing the total cost into smaller payments, consumers can better manage their cash flow and make purchases that are otherwise outside of their budgets. This is particularly appealing for large ticket items or unexpected expenses (36% of consumers prefer BNPL due to lower interest rates than traditional credit cards.)

There are also changing consumer habits and a desire for financial flexibility. Younger generations, particularly Gen Z, appreciated the transparency of fixed payment plans. As eCommerce continues to grow and consumers seek more control over their finances, BNPL has emerged as a compelling option that corresponds with current shopping preferences.

How Does BNPL Work?

Buy Now, Pay Later’s payment structure involves fixed installments distributed across several weeks or months. Many BNPL providers offer interest-free periods, allowing customers to avoid additional costs by adhering to the agreed-upon payment schedule.

Eligibility requirements vary by provider but usually entail a soft credit check and basic income verification. Some BNPL services are more lenient than traditional lenders, making them accessible to a wider range of consumers.

Using BNPL is a simple process:

- Sign up: Create an account with a BNPL provider through their website or app.

- Link payment: Connect a bank account or credit card to your BNPL account.

- Shop: Select the BNPL option as your payment method at checkout.

- Approve purchase: The BNPL provider quickly reviews and approves your purchase.

- Receive items: The provider pays the merchant, and your items are shipped or available for pickup.

- Make payments: Follow the agreed-upon payment schedule, managing your account through the provider’s platform.

- Stay responsible: Ensure timely payments to avoid late fees and potential negative impacts on your credit score.

While BNPL offers a flexible alternative to traditional credit, allowing consumers to manage their cash flow while making desired purchases, it’s crucial to understand the terms and commit to responsible usage to maximize the benefits of this payment option.

BNPL Benefits and Drawbacks to Consider

BNPL’s enhance the shopping experience while potentially making larger purchases more accessible.

Pros of BNPL

Here’s a look at the key advantages Buy Now, Pay Later services offer for both consumers and merchants.

Flexibility

- Consumer: Lets customers spread payments over time while receiving items immediately, which is ideal for large or unexpected expenses.

- Merchant: Increase sales by making products accessible to customers who lack immediate funds, potentially leading to higher average order values.

Easy Access

- Consumer: Typically offers a simplified application process with quick approval times, often right at the point of sale, making it convenient for online and in-store shopping.

- Merchant: A streamlined approval process reduces friction in the purchasing journey, potentially increasing conversion rates and minimizing cart abandonment.

Credit Score Implications

- Consumer: May boost consumer credit scores when used responsibly.

- Merchant: Offering a financial option that helps customers build credit attracts those looking to improve their financial health, potentially fostering customer loyalty.

Budgeting Benefits

- Consumer: Can be a useful tool for managing finances. Fixed payment schedules help shoppers plan expenses, and many BNPL apps offer features to monitor outstanding balances and upcoming payments.

- Merchant: Customers who feel more in control of their finances are more likely to make purchases, which could increase sales and lead to repeat business.

Don’t miss out on the opportunity to boost sales and customer satisfaction. Get a demo now and see how BNPL can transform your business.

Ready to Explore How BNPL Can Enhance Your Payment Options?

E-Complish's BNPL solutions empower your business to offer interest-free financing, helping your customers spread out payments and budget responsibly.

Cons of BNPL

As these payment options become more widespread, it’s crucial to understand their potential pitfalls.

Hidden Costs

- Consumer: Can have hidden fees and high-interest charges, particularly for late or missed payments, which can significantly increase the total cost of purchases.

- Merchant: Typically involves higher transaction fees than traditional payment methods, which may reduce profit margins.

Financial Risks

- Consumer: Ease of use may lead to overspending and accumulating debt, as the full cost of purchases isn’t immediately felt, potentially causing financial strain over time.

- Merchant: There’s an increased risk of chargebacks or customer defaults, which can affect revenue and create additional administrative burdens.

Credit Implications

- Consumer: Timely payments can boost credit scores, but missed BNPL payments severely damage credit ratings, affecting future borrowing capabilities.

- Merchant: May attract customers with lower credit quality, potentially increasing the risk of bad debt and affecting the business’s financial health.

Availability and Integration

- Consumer: Not universally accepted, limiting shopping options and potentially causing inconvenience when preferred retailers don’t offer this payment method.

- Merchant: Requires ongoing compliance efforts and adaptations, increasing operational complexity and costs.

How BNPL Differs from Other Forms of Financing

But what really sets this financial upstart apart from the old guard?

| Feature | BNPL | Credit Cards | Personal Loans |

|---|---|---|---|

| Purpose | Specific purchases | Everyday purchases | Larger expenses |

| Loan Amount | Smaller | Varies | Larger |

| Interest | Often interest-free initially, then applies | Variable, often high | Fixed or variable, typically lower |

| Repayment | Fixed installments | Minimum monthly payments | Fixed monthly payments |

| Credit Impact | Can impact positively or negatively | Significant impact | Significant impact |

| Eligibility | Usually easier to qualify | Requires good credit | Requires strong credit |

| Fees | Late payment fees, transaction fees | Annual fees, transaction fees | Origination fees, late payment fees |

| Convenience | Convenient for online/in-store | Convenient for everyday use | Requires application & documentation |

| Transparency | May not be transparent | Generally transparent | Clearly defined terms |

While traditional credit options often burden users with complex terms and hefty interest rates, Buy Now Pay Later (BNPL) cuts through the clutter with transparent, often interest-free installments. This consumer-friendly approach, seamlessly woven into the online shopping experience, gives BNPL a clear edge.

E-Complish — Your Trusted Partner in Payment Processing

Buy Now Pay Later (BNPL) offers a seductive mix of instant gratification and bite-sized payments that has Gen Z, millennials, and retailers buzzing. To capitalize on this payment revolution, businesses need a trusted partner with the expertise to implement and manage these complex systems effectively.

With E-Complish, you gain access to:

- Seamless BNPL integration across multiple platforms

- Customized solutions tailored to your business model

- Robust security measures to protect transactions

- Streamlined payment processes for improved cash flow

- Comprehensive analytics to track BNPL performance

Our payment experts are ready to guide you through the complexities of BNPL adoption. We’ll work closely with you to develop a strategy that meets your business goals and enhances customer satisfaction.

Don’t let the BNPL revolution pass you by. Reach out to us for expert consultation and customized BNPL payment solutions.

Table of Contents

FAQ

Can I use BNPL for any purchase?

Am I protected when using BNPL?

What happens if I’m late with a BNPL payment?

- Late fees: Most providers charge fees for missed payments.

- Interest charges: Some may start charging interest on the outstanding balance.

- Credit score impact: Late payments could be reported to credit bureaus, negatively affecting your credit score.

- Account restrictions: Your BNPL account might be frozen, preventing further purchases.

- Debt collection: Persistent non-payment could send your debt to collections.

Table of Contents