Updated by 06.18.2025

Card-Present vs. Card-Not-Present Transactions: Which Is Right for Your Business?

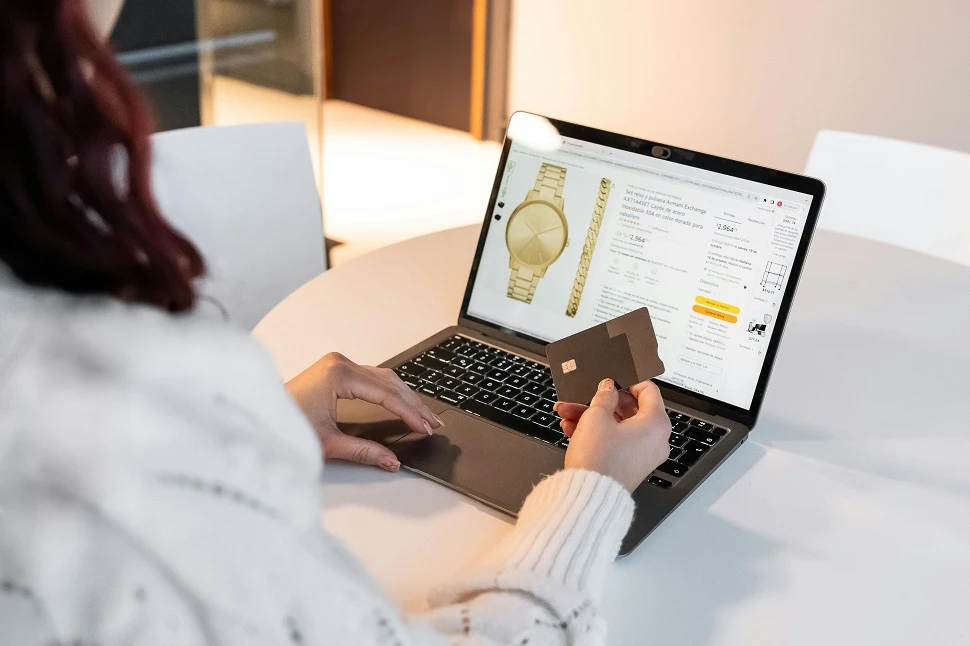

Let’s say you’re browsing online for the perfect gift, add it to your cart, and with a few clicks, it’s on its way. Meanwhile, a shopper swipes their card across town at a local boutique. Two purchases, two vastly different experiences, yet both are the lifeblood of modern commerce.

As a merchant, which type of payment is right for your business?

Hint: It’s not as simple as whether you have a physical store.

Especially since global revenue in the eCommerce market is projected to reach $4,117 billion. Moreover, 50% of US eCommerce revenue comes from smartphones, so not having a mobile-friendly checkout process is costly.

Let’s break down the differences between card-present vs. card-not-present payments to help you make an informed choice about the payment solutions you offer customers.

What Is a Card-Not-Present Transaction?

Online payment trends have shifted dramatically, with Card-Not-Present (CNP) transactions becoming increasingly prevalent as more consumers embrace e-commerce and digital shopping experiences. A Card Not Present (CNP) transaction is a way to pay without physically using your credit or debit card. It’s common for online shopping, phone orders, or mail purchases.

Instead of swiping or inserting your card as you would in a store, you provide your card details differently – typing them on a website, stating them over the phone, or writing them on an order form. The merchant then processes your payment using this information despite not having your physical card.

What makes this digital payment technology unique:

- Remote: CNP transactions occur when purchases are made online, over the phone, or through mail order.

- No physical card: Merchants don’t have direct access to the physical card or its magnetic stripe/EMV chip data.

- Manual entry: Customers enter card details manually

Common CNP transactions include:

- Online Invoice Payments: Secure web portals for electronic bill payments.

- Mail Order (MO): Purchases made through the postal service.

- Recurring Payments: Automated payments for ongoing services.

- Phone Orders (MOTO): Purchases made over the phone.

- Mobile Payments: Payments made using a mobile device.

- Electronic Bill Payment (E-bill payments): Direct bank payments through online banking.

- Pay-by-text Payments: Payments initiated via SMS payment solutions.

Benefits of Card-Not-Present Payments

Card-Not-Present (CNP) payment transactions offer advantages for businesses and consumers:

- Convenience: Whether it’s 3 AM or a busy workday, consumers can shop and pay at their leisure without the constraints of traditional business hours or physical locations.

- Expanded Reach: Accepting online payments allows companies to cater to customers across different time zones and geographical boundaries, significantly expanding their potential customer base and revenue streams.

- Cost-Effective: A reduced need for physical point-of-sale systems and lower staffing requirements for in-person transactions streamline operations.

- Data Insights: Gain valuable insights into purchasing patterns, preferences, and behaviors, enabling tailored offerings and improved marketing strategies.

- Customer Satisfaction: With fewer steps in the checkout process and the ability to save payment information for future purchases, customers enjoy a frictionless buying experience, encouraging repeat business and loyalty.

Consider this: Over 80% of small businesses in the USA now accept CNP payments and companies that don’t offer CNP options risk falling behind. It’s not just losing individual sales, though that’s certainly part of it. The bigger picture is about staying relevant in an increasingly digital marketplace.

Don’t lose out on your market share. Optimize your payment processing with E-Complish. Get a demo now!

Challenges of Card-Not-Present Payments

It’s not just losing out on potential customers; heightened fraud risks and complex security requirements demand vigilance and adaptation when using CNP payments.

- Fraud Risk: CNP transactions are particularly vulnerable to payment fraud. Verifying a transaction’s legitimacy is more complex. Bad actors can exploit stolen card information or engage in identity theft, leading to unauthorized purchases and financial losses for businesses and consumers alike.

- Payment Security: Robust security protocols such as advanced encryption methods, tokenizing sensitive data, and cutting-edge fraud systems are necessary to combat fraud risks. Businesses must also stay informed of mobile payment security as more transactions shift to smartphones and tablets.

- Compliance: Plus, the importance of CPI compliance for merchants cannot be overstated as it’s fundamental to safeguarding customer data and maintaining trust. The PCI DSS protects data, providing a framework of security measures that all businesses handling card payments must adhere to remain compliant.

As technology advances, so must our approaches to securing these vital payment channels, ensuring that convenience never comes at the cost of security – unfortunately, this is an ongoing pursuit.

What Are Card-Present Transactions?

Card-present transactions are how we’ve been paying for things with plastic since credit cards became popular, long before online shopping took over. It’s the traditional way of using your card to purchase products and pay for services in person – when you pull out your card and hand it to the cashier or slide it through the machine yourself.

There are five different ways to utilize card-present transactions:

- Magnetic Stripe (Magstripe) Transactions: The traditional method where customers swipe their cards through a terminal. While still in use, it’s gradually being phased out due to security concerns.

- Chip and PIN Transactions: Customers insert their EMV chip-enabled cards and enter a PIN for verification. This method offers enhanced security through encryption and authentication protocols.

- Contactless Transactions (NFC): Allow customers to tap or wave their cards near a compatible terminal, utilizing Near Field Communication technology for quick and convenient payments.

- Mobile Payments with Card Reader: Involves portable card readers attached to mobile devices so businesses can accept card payments on the go or at temporary locations.

- In-store Purchases: Usually entail traditional point-of-sale (POS) payments.

Pros of Card-Present Payments

This traditional payment method is still a top choice in many face-to-face retail scenarios.

- Customer Convenience: With a simple swipe, dip, or tap of their card, shoppers can complete purchases effortlessly. This method requires no additional setup or technology beyond the card they already carry. The speed and ease of these transactions contribute to smoother checkout processes and improved customer satisfaction, especially in busy brick-and-mortar retail environments where time is of the essence.

- Reduced Risk of Fraud: When a card is physically present, merchants can verify its authenticity by examining security features like holograms and chip technology. Additionally, the cardholder’s identity can be confirmed through signature comparison or PIN entry. These layers of verification significantly decrease the likelihood of fraudulent transactions.

- Reduced Chargeback Risks: The physical presence of the card and the cardholder at the point of sale provides stronger evidence of a legitimate transaction. For merchants, this translates to fewer contested transactions, lower operational costs associated with managing disputes, and improved overall financial stability.

Card-present payments have lower chargeback rates and often cheaper fees – some start at 2.6% + $0.10, while online payments can cost up to 3.5% + $0.30. That’s why many stores keep offering in-person card payments alongside newer options.

Cons of Card-Present Payments

Despite their ubiquity, the downsides of card-present payments can impact operational efficiency, customer reach, and even security.

- Equipment Costs: The initial cost of setting up a POS system can range from $0 (using free software and existing hardware) to $2,000 or more for a comprehensive system.

- Security Risks: Skimming devices can be attached to card readers to steal customer data, and businesses must be vigilant against fraudulent transactions using stolen cards.

- Limited Reach: Card-present payments are restricted to customers who can physically visit your location, which reduces your customer base, especially compared to online or remote payment options.

- Operational Complexity: Maintaining inventory, processing transactions efficiently, and providing in-person customer service can be resource-intensive.

- Limited Data Insights: Card-present payments provide less detailed information about customer behavior and preferences, hindering efforts to personalize marketing strategies and improve customer experiences.

- Chargeback Potential: Customers may dispute transactions due to dissatisfaction or card-related issues, which could lead to financial losses and administrative headaches.

- Vulnerability to Security Breaches: Despite security measures, physical POS systems can be compromised, leading to data breaches.

As the digital economy evolves, merchants should consider diversifying their payment options to mitigate these challenges and maximize their business potential.

Card-Present vs. Card-Not-Present: Which One to Choose?

The choice between card-present and card-not-present payment options largely depends on a business’s model, target audience, budget, security concerns, and desired customer reach.

| Feature | Card-Present Transactions | Card-Not-Present Transactions |

|---|---|---|

| Definition | Payment made when the physical card is present at the point of sale (POS). | Payment made when the physical card is not present at the point of sale. |

| Common Uses | In-store purchases, mobile payments with a physical card reader. | Online purchases, phone orders, mail-order transactions. |

| Security | Generally considered more secure due to physical verification of the card. | Higher risk of fraud due to lack of physical verification. |

| Fraud Potential | Skimming devices, stolen cards. | Phishing scams, stolen card details, unauthorized use. |

| Processing Costs | Typically lower due to simpler processing. | Often higher due to additional fraud prevention measures and processing complexities. |

| Convenience | Faster transaction times, convenient for customers. | More flexible for customers, available 24/7. |

| Customer Reach | Limited to customers physically present at the POS. | Can reach a wider customer base through online channels. |

Brick-and-mortar stores naturally lean towards card-present transactions, while e-commerce businesses primarily use card-not-present methods. However, in today’s diverse retail landscape, many businesses find that a hybrid approach offers the best of both worlds.

We recommend accepting both card-present and card-not-present payment types to maximize flexibility and customer convenience. The question often isn’t whether you should implement CNP transactions but when. You can use the following questions to determine the urgency of adding CNP capabilities to your payment ecosystem:

- Is your business primarily physical, online, or both?

- Where are your target customers located?

- What are your current and planned sales channels?

- What’s your budget for payment processing fees and equipment?

- How much fraud risk can your business tolerate?

- Do you have the technology to handle online payments securely?

- What are your business growth plans for the next 1-3 years?

- What’s the average value of a typical transaction?

- How important is detailed customer data for your marketing strategy?

- What payment methods do your competitors typically use?

Implementing flexible CNP payments doesn’t have to be a headache. E-Complish offers comprehensive card-not-present payment solutions, including online gateways, virtual terminals, and recurring billing systems. With built-in fraud prevention, mobile options, and detailed analytics, we help businesses expand payment capabilities securely. Plus, our team will guide you every step of the way.

Simplify Business Transactions with E-Complish

While card-present transactions come with lower fraud risk and fees, card-not-present options offer broader reach and flexibility. Implementing card-not-present capabilities is increasingly crucial for staying competitive and meeting customer expectations.

Whether you’re looking to get new or enhance existing payment systems, E-Complish offers expert consultation and customized payment solutions to meet your specific needs – pay-by-text payments, mobile payments, and online invoice payments – we offer them all and more.

Don’t let payment limitations hold your business back. Reach out to us to explore how E-Complish can optimize your payment processing strategy and drive your business forward.

Table of Contents

Table of Contents