Table of Contents

Updated by 03.27.2025

10 Benefits of Offering Electronic Bill Payment Options

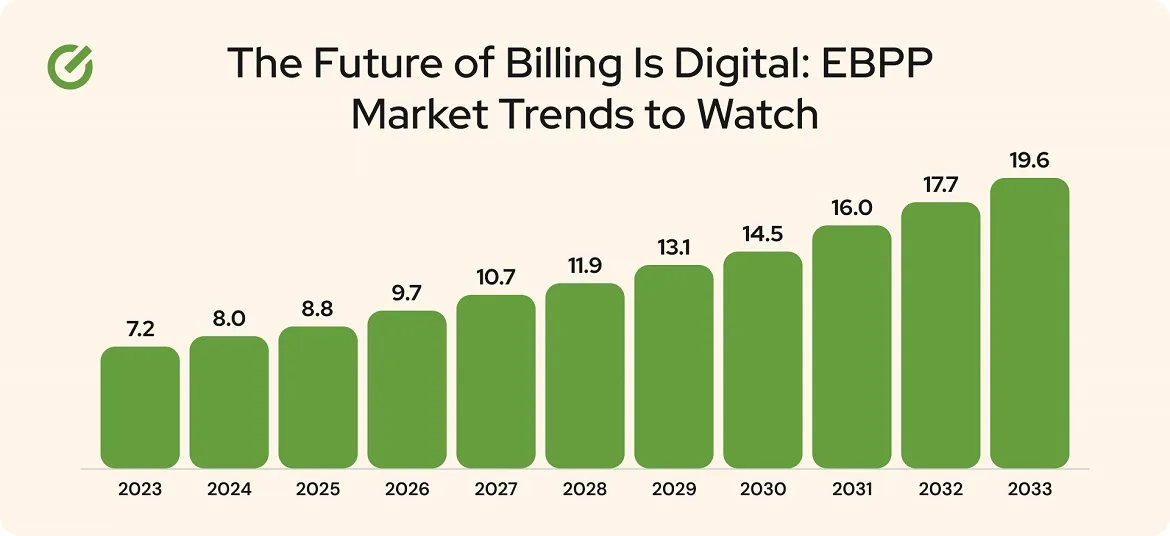

Do you want to make your and your clients’ lives easier? Electronic Bill Payment and Presentment (EBPP) could be the solution. As one of the must-have payment technologies, EBPP can simplify your invoice management process, build customer trust, and increase engagement.

Although digital payment solutions have become more popular lately, many people are unaware of all the advantages of e-billing. This blog post will explain ten benefits of e-billing to help you decide if it is the right option.

What Is Electronic Bill Payment?

Electronic Bill Payment and Presentment (EBPP) is a system where businesses send bills electronically, and customers pay them online. It replaces paper bills and checks with digital delivery and transactions.

For businesses, EBPP cuts costs by removing printing and mailing expenses. It also speeds up payments, improves cash flow, and tracks everything automatically. For customers, it’s simple: bills arrive via email or a portal, and they can pay instantly from any device.

EBPP’s main job is to handle bill presentation and payment digitally. Businesses save resources (up to 42% on payment processing costs), customers save time, and both ditch the paper hassle, making it efficient and practical.

How EBPP Works

Electronic Bill Payment and Presentation (EBPP) simplifies billing with a straightforward process. Here are the key steps.

- Bill generation: The business creates an electronic bill using billing or accounting system data. This happens automatically, pulling details like customer info and amounts owed into a digital format.

- Delivery: The bill is sent to the customer through email, an online portal, or a mobile app. Customers are notified instantly, and there is no waiting for mail.

- Presentation: Customers access the bill digitally by logging into a portal, opening an email, or checking an app. It shows what’s owed and the payment due date.

- Payment: Customers pay online with options like a credit card, debit card, or bank transfer. They pick what works, enter details, and submit. Done in minutes.

Thus, EBPP ties everything together into a fast, reliable system. Businesses reduce overhead, customers gain control, and payments clear quickly, proving it’s a practical upgrade over traditional billing.

Types of Electronic Billing Systems

Electronic billing comes in various forms, each suited to different needs:

- Direct data transmission: Businesses use secure file transfers to send billing data straight to a customer’s system, like a bank or payment processor. It’s fast and automated, ideal for large transactions.

- Email billing: Bills are sent as attachments or links in an email. Customers get a PDF or a clickable payment option.

- Online portal billing: Customers log into a secure website to view and pay bills. Portals store payment history and allow scheduling, offering control and convenience.

- Self-billing: Customers generate bills based on agreed terms, often used in B2B setups. The business reviews and approves, streamlining recurring payments.

- Mobile billing: Bills arrive via a mobile app or text, with built-in payment options. It’s quick and fits on-the-go lifestyles, often with push notifications.

- Integrated ERP systems: Billing is embedded in enterprise software like SAP or Oracle. It pulls data from sales and accounting, automating the process for big companies.

Each type is tailored to specific workflows or customer preferences.

Businesses That Can Benefit From EBPP

Electronic Bill Payment and Presentment (EBPP) suits a range of businesses, boosting efficiency and satisfaction:

- High invoice volume: Companies like utilities and telecoms process thousands of bills monthly. EBPP automates delivery and payments, cutting delays and manual work.

- Recurring billing: Subscription services and memberships thrive with EBPP. It schedules automatic payments, ensuring steady cash flow without chasing customers.

- Cost reduction focus: EBPP is a win-win for any business aiming to save money. It reduces printing, postage, and processing costs, freeing up resources.

- Customer-centric approach: EBPP offers easy access and flexible payment options, improving customer experience. Happy clients stick around longer.

- Environmentally conscious: Businesses focused on sustainability love EBPP’s paperless approach. It reduces waste and aligns with green values.

- Specific industries: Sectors like healthcare and insurance benefit from streamlined billing. EBPP handles complex invoices and speeds up reimbursements.

From high-volume operations to niche markets, EBPP delivers practical advantages. It’s a smart fit for businesses prioritizing efficiency, savings, and customer loyalty.

Say Goodbye to Paper Bills!

E-Complish makes it easy to adopt cutting-edge EBPP solutions to streamline your payments and delight your customers.

The Advantages of an E-Billing System

EBPP offers benefits traditional payment methods can’t match. Here’s why it’s a no-brainer:

1. Reclaim Your Team’s Time with Automation

Manual invoicing and check processing burns through time and staff resources, especially when resending lost paperwork. Electronic invoices with payment links (cards, mobile, text) eliminate these headaches while adding automated billing options. Your operation gets leaner with every electronic payment you process.

2. Slash Billing Costs by 90%: The Paperless Advantage

Going paperless slashes billing costs by up to 90%. It eliminates paper, printing, and postage expenses that eat away 85% of your invoice budget. Even better, digital-first companies generate 17% more revenue and enjoy 55% higher profitability after the initial technology investment.

3. Tap into the Mobile Payment Revolution

85% of Americans own smartphones, with 70% preferring digital payments. Therefore, over 50% are willing to pay electronic bills from their phones, expediting the payment process while providing businesses with valuable consumer spending insights.

4. Build Customer Loyalty Through Payment Simplicity

Businesses offering diverse payment options increase customer satisfaction and improve cash flow. Though often neglected, streamlined online bill payment provides a competitive advantage.

5. Bank-Grade Security Without the IT Overhead

Online payments provide bank-grade security. While implementing these security protocols independently is costly, organizations can partner with PCI-compliant service providers like E-Complish to protect against cybersecurity risks.

6. Focus on Growth, Not Payment Collection

Automated online payments free your staff from tedious billing tasks, letting them focus on more rewarding work. Pre-authorization eliminates the nightmare of bounced checks. Your team stops chasing payments and starts driving business growth instead.

7. Meet Modern Payment Expectations to Stay Competitive

In this competitive environment, businesses can’t risk losing customers due to slow payment procedures. Digitizing operations is the best solution for old and new businesses.

8. Welcome More Clients

Online payment processing expands your client base by making payments accessible to everyone, everywhere. Watch applications surge as payment barriers fall.

9. Turn Payment Friction Into Cash Flow Freedom

Patients can settle bills with a few clicks from anywhere, while your practice benefits from faster collections and reduced DSO. No more wasted time or money on reminder letters.

10. The “Set It and Forget It” Revenue Advantage

Empower patients to sync payments with paydays and watch your revenue flow effortlessly. This “set-it-and-forget-it” system eliminates missed payments and collection nightmares forever. Your practice gets paid automatically. Zero effort, no excuses, no delays.

Challenges EBPP May Face

Though e-billing benefits are obvious, implementation hurdles remain. Here are three prevalent challenges your business may encounter.

- Security concerns: EBPP handles sensitive data (credit card numbers, bank details), making it a cyberattack target. Vulnerabilities like weak encryption or phishing risks can lead to data breaches and identity theft. Robust security measures, such as multi-factor authentication and end-to-end encryption, are non-negotiable to safeguard trust and compliance.

- Customer adoption: Not everyone embraces digital billing. Older customers or those wary of technology often cling to paper bills, resisting change. Convincing them requires clear communication via step-by-step guides, tutorials, and incentives like e-payment discounts. Without education and outreach, adoption lags, stalling EBPP’s full potential.

- Technical issues: Glitches happen. System crashes, slow portals, or payment processing errors can block bill access or delay funds. Downtime frustrates customers and disrupts cash flow. A reliable tech backbone, backed by proactive monitoring and swift customer support, is critical to keep EBPP running smoothly.

Overcoming these obstacles unlocks EBPP’s promise of efficiency and savings. For expert guidance, you can trust E-Complish. We help businesses navigate security, adoption, and tech challenges with tailored payment solutions and deep industry know-how.

Maximize Your Business Potential with E-Complish

Electronic billing trims expenses by eliminating paper and postage, ensures faster payments for reliable cash flow, and offers customers straightforward digital access. It suits businesses handling numerous invoices, such as utilities, or managing regular charges, like subscriptions.

Adopting e-billing keeps operations lean and aligns with what customers expect.

E-Complish provides e-billing services tailored to your needs. Our offerings include secure payment tools, an intuitive portal, and seamless system integration designed to eliminate billing hiccups and improve efficiency.

Curious how it works? Contact us today for a demo and discover how we can sharpen your business edge.

Table of Contents