Updated by 10.02.2024

How to Get a Merchant Account: A Step-By-Step Guide

69% of US adults use digital payment methods to buy goods and services. Customers expect the convenience of paying electronically. For businesses to thrive, accepting online payments is no longer optional.

This is where merchant accounts come in — they act as the bridge between your business and the world of electronic transactions. However, setting up a merchant account can feel overwhelming.

E-Complish is here to simplify the journey! This comprehensive guide is designed to be your one-stop resource for understanding how to get a merchant account and streamline your business’s setup process.

We’ll explain everything you need to know, from fee structures to integrating payment solutions, empowering you to accept online payments and confidently unlock new growth opportunities.

What Is a Merchant Account?

A merchant account is a business bank account that allows you to accept credit, debit, and other electronic payments. It is a central repository that holds onto funds before they’re transferred to your primary business bank account.

Any business that wants to offer electronic payment options needs a merchant account. Examples include utility companies, financial institutions, retail stores, service providers, eCommerce stores, and restaurants.

How it works:

- A customer initiates a transaction by using their credit or debit card.

- The merchant’s payment processor securely transmits the transaction details to the customer’s card issuer (bank).

- The card issuer verifies the customer’s account information and approves or denies the transaction.

- If approved, the card issuer sends authorization back to the merchant’s payment terminal.

- The funds are transferred from the customer’s bank account to the merchant’s account within 1-3 business days.

Merchant accounts have transformed how businesses accept payments, bringing security, convenience, and efficiency to the process for businesses and their customers.

Traditional Merchant Accounts vs Aggregator Accounts

Businesses have two main options for accepting credit card payments: traditional merchant accounts and aggregator services like E-Complish.

Traditional merchant accounts offer a more customized experience. You apply directly to the merchant services provider and receive your dedicated merchant account upon approval. You then choose the payment processor that verifies card details and personalizes the checkout experience for your customers. Transaction fees can usually be negotiated if there’s a high sales volume, potentially leading to lower costs.

On the other hand, aggregator services, like E-Complish, provide a faster and simpler setup, allowing many businesses to accept credit cards under their umbrella merchant account. This translates to a quicker and easier application process, getting you up and running faster. Fees are typically transparent and structured as a flat fee or percentage per transaction, which is a great benefit to any and all businesses.

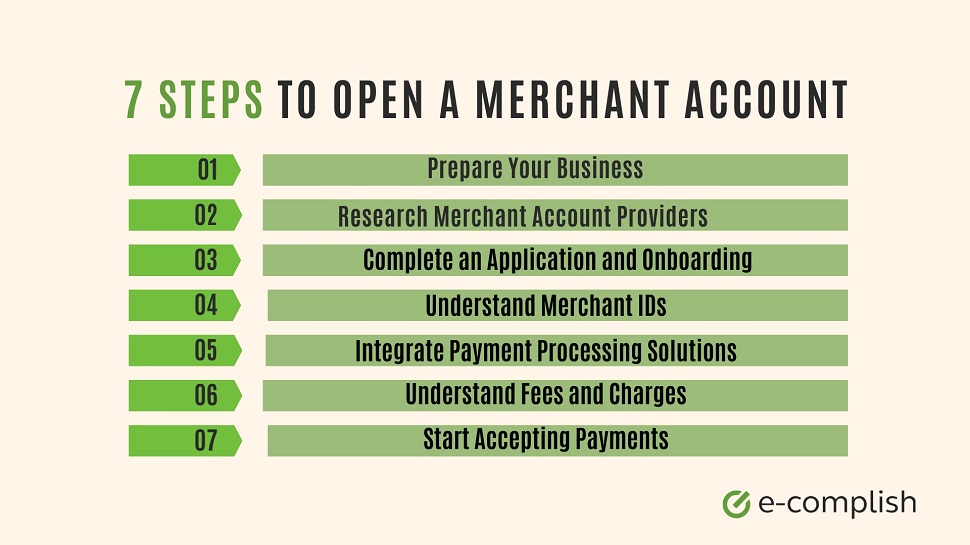

Open a Merchant Account in 7 Steps

E-Complish specializes in payment solutions for businesses with merchant accounts. Let’s guide you through how to create a merchant account, equipping you with the necessary information and valuable tips to make your set-up seamless.

Step 1: Prepare Your Business

Your company should be registered and established to qualify for a merchant account.

Get a Business License and Relevant Permits

To become a legal entity, register your business with the relevant government agency based on your location and chosen business structure.

Depending on your industry and local regulations, you may need to obtain specific licenses and permits. For instance, restaurants must pass a health department inspection and acquire a food handler’s permit.

Secure an Employment Identification Number (EIN)

EINs are unique tax identification numbers issued by the Internal Revenue Service (IRS). They are similar to an individual’s Social Security number (SSN) but specifically for businesses.

An EIN streamlines business tax filing facilitates opening a separate bank account, and distinguishes business and personal finance. It also demonstrates to potential clients, vendors, and partners that you’re a serious and registered business entity.

Applying is straightforward; just visit the IRS website.

Open a Separate Business Bank Account

While a merchant account allows you to process electronic payments, it’s not a substitute for a dedicated business bank account. This separate account keeps your business finances organized and transparent.

Having two separate accounts simplifies bookkeeping, allowing you to track income and expenses effectively. Furthermore, some merchant account providers might require a dedicated business bank account to deposit your sales proceeds.

Consider these prerequisites as an investment in your business’s future, paving the way for secure and efficient electronic payment processing.

How long does it take to get a merchant account? It usually takes about a few business days, depending on your business and how prepared you are.

Step 2: Research Merchant Account Providers

Choosing the right merchant account provider is crucial as it affects profits, customer satisfaction, and operational efficiency.

Basic Merchant Account Considerations

- Fees: Look for providers that outline their fee structure, including monthly fees, per-transaction charges, and any potential gateway fees. Compare pricing models across different options to find one that aligns with your business volume.

- Processing times: How quickly do you receive your funds after a transaction? Faster processing times mean quicker access to your working capital.

- Customer support: Reliable and responsive customer support is vital for resolving issues. Providers offering multiple support channels (phone, email, live chat) with knowledgeable representatives are best.

- Security features: Ensure your chosen provider prioritizes security with features like PCI compliance, fraud prevention tools, and robust encryption protocols to protect customer data.

- Integration ease: How seamlessly does the merchant account integrate with your existing systems (e.g., shopping cart, accounting software)?

Business-Specific Considerations

Some providers offer a wider range of features to cater to specific business needs. These include credit card processing to accept various cards and expand your customer base, e-commerce support with secure online payment solutions for your website, loyalty programs to keep customers coming back, and recurring billing to automate payments for subscription services.

Banks vs. Financial Service Companies

Traditionally, banks offered merchant account services. However, many financial service companies like E-Complish are now strong players in this market. While banks may offer competitive rates for established businesses with high volume, they often have a more complex application process. On the other hand, financial service companies can be faster and easier to work with, particularly for startups and small businesses.

How E-Complish Stands Out

We provide a variety of merchant account solutions to match your specific requirements.

Our competitive advantages include:

- Specialized services: Implement e-signature, online invoice payments, text-to-pay, and more – a one-stop shop for payment processing needs.

- Reasonable rates: We utilize a transaction-based fee system rather than incorporating setup and maintenance fees.

- Robust security features: Fully PCI-compliant, encryption, tokenization, and 2FA.

- Seamless integrations: Our DevConnect makes connecting legacy systems to our ACH and credit card back-end processors easy using a unified API.

- Exceptional support: We’re available 24/7 to help our clients.

By prioritizing your business needs and carefully researching merchant account providers, you can apply for a merchant account that empowers you to accept payments efficiently and securely.

Step 3: Complete an Application and Onboarding

Here’s a breakdown of what to expect when you apply for a merchant account, along with how E-complish simplifies things for you:

Gathering Your Documents

Before diving into the formal application, take some time to collect the necessary documents:

- Business documents: Business license, registration documents, and any relevant permits.

- Financial statements: Previous card processing statements, if available.

- Ownership information: Proof of ownership and identification for all business owners.

The Application and Onboarding Process

- Submit your application: E-complish provides a user-friendly online application form. Simply fill in the required information and submit it for review.

- Underwriting process: The underwriter will assess your application and financial health to determine your eligibility. We help streamline communication and keep you updated throughout this stage.

- Approval and account setup: Once approved, E-complish sets up your account and integrates it with your existing systems (e.g., shopping cart, accounting software), minimizing technical hurdles.

- Equipment setup (if needed): Specific payment processing equipment might be required for certain businesses. We’ll help set this up and ensure everything is functioning smoothly.

- Accounting integration: We’ll also facilitate the seamless integration of your merchant account with your accounting software to simplify record-keeping and financial management, along with E-Complish’s reporting tool.

While the core steps remain similar across providers, we go the extra mile. Our dedicated support team provides personalized guidance throughout the application and onboarding process. They handle the complexities, so you can start accepting electronic payments with confidence.

Step 4: Understand Merchant IDs (MIDs)

A merchant ID is a unique identifier for your business within the electronic payment ecosystem. It identifies your business to the payment processor, verifies the transaction details, and ultimately instructs the transfer of funds to your merchant account.

This ensures a secure and transparent flow of funds for your business and customers. Without an MID, your business would be invisible to the payment processing network, rendering electronic payments impossible.

Here are some general tips for finding your MID:

- Review account statements: Often, your MID is printed on your monthly merchant account statements.

- Access your online account portal: Many providers offer online account portals where you can view your account details, including your MID.

- Contact your merchant account provider: If you’re unsure where to find your MID, the most straightforward approach is to contact your merchant account provider directly. Their customer support team can assist you in locating this crucial information.

Step 5: Integrate Payment Processing Solutions

It’s possible to transform your business website into a virtual payment terminal with the right payment processing solution.

Beyond fees and security features, you’ll want to consider offering your customer base popular payment options like e-wallets (e.g., Apple Pay, Google Pay) and ACH payments (direct bank transfers).

Be sure to cater to your customer base by offering popular options like credit/debit cards, E-wallets (e.g., Apple Pay, Google Pay), and ACH payments (direct bank transfers).

Understanding your target demographic is crucial, too. Younger generations favor mobile wallets, tap-to-pay, and text-to-pay.

Then, there are also specific features you might want to enhance your payment offerings:

- ACH payment processing: Ideal for recurring subscriptions, invoices, or B2B transactions, ACH payment processing allows customers to pay directly from their checking accounts.

- Text to pay: Simplify payments by allowing customers to receive and pay invoices or access payment options via text messages.

- Electronic bill and presentment: Deliver bills and invoices electronically for faster payments and reduce paper waste.

- Recurring payments: Automate billing for subscription-based services, memberships, or installment plans.

- E-signature: Allow customers to sign documents or agreements during checkout electronically.

IVR payments: Integrate with Interactive Voice Response (IVR) systems for secure phone-based payments. - Chargeback management: Minimize fraudulent chargebacks with tools to dispute unauthorized transactions.

- Customer portal: Provide a secure customer payment portal where clients can manage account information, view past transactions, and make payments conveniently.

Step 6: Understand Fees and Charges

Fees directly impact your business profitability. Understanding the fee structure of your chosen merchant account provider allows you to accurately calculate the cost of accepting electronic payments.

- Transaction fees: This is typically the most significant cost, often comprising a percentage of each transaction amount plus a fixed per-transaction fee. Rates can vary depending on your industry, processing volume, and chosen payment method (e.g., credit cards might have higher fees than debit cards).

- Monthly statement fees: Some providers charge a monthly fee for maintaining your merchant account, regardless of transaction volume.

- Gateway fees: The payment gateway that facilitates the connection between your website and the processing network might have its own fees. These might be included in the transaction fee structure or billed separately.

- Chargeback fees: If a customer disputes a transaction and their bank rules in their favor, you’ll incur a chargeback fee alongside the refunded amount. Minimizing chargebacks through clear communication and proper fraud prevention measures is crucial.

- PCI compliance fees: Maintaining PCI (Payment Card Industry) compliance ensures data security. Some providers might charge an annual fee for PCI compliance validation or offer it as part of their service package.

Step 7: Take Final Steps and Start Accepting Payments

Now comes the exciting part: going live and accepting customer transactions.

Here’s how to ensure a smooth transition:

Sandbox Testing

Most payment processors offer a secure testing environment (sandbox) that allows you to simulate real-world transactions without processing actual funds. Use this opportunity to thoroughly test all payment functionalities, identify and fix glitches, and refine your checkout process to guarantee a seamless customer experience.

Prioritizing PCI Compliance

The Payment Card Industry Data Security Standard (PCI DSS) outlines a comprehensive framework for protecting sensitive customer information. By partnering with a PCI-compliant provider, you demonstrate your commitment to data security and build trust with your customers. Rest assured, our advanced and secure technologies ensure PCI compliance.

Once You’ve Gone Live

You should always monitor your payment processing system to identify threats and optimize performance:

- Monitor transactions: Track your activity closely to identify suspicious patterns or potential fraud attempts. Look for unusual spikes in volume, multiple failed payment attempts, or geographically inconsistent transactions.

- Communicate clearly: Inform your customers about your new payment options and any changes to your checkout process. Update your website and marketing materials with clear instructions on completing online transactions.

- Chargeback Management: Stay on top of chargebacks (disputed transactions). Analyze trends to identify recurring issues that might be causing customer dissatisfaction. Respond promptly to chargeback requests with relevant documentation to increase your chances of winning disputes.

- Provide excellent customer support: Be readily available to address any questions or concerns your customers might have regarding online payments. Prompt and helpful support builds trust and fosters a positive customer experience.

Payment Systems Go with E-Complish!

Taking your business to the next level with electronic payments is easier than you think! This guide has unpacked the process, simplifying each step from application to integration. Don’t let the perceived complexity hold you back from setting up a merchant account.

Now, you can successfully embark on this journey with E-Complish, your trusted partner in secure and efficient payment processing. Our dedicated team offers ongoing support and a wide range of services to ensure a seamless experience. Reach out to us today! Let E-Complish empower your business to thrive in the world of e-commerce.

Table of Contents

Table of Contents