Updated by 11.25.2025

QR Code Payments: Contactless Transactions for Your Business

In the U.S., about 102.6 million smartphone users are expected to have scanned QR codes by 2026. Meanwhile, the QR-code payments market is projected to hit around US $500 billion with further growth into 2026.

E-Complish’s payment solutions are at the forefront of the QR code payment revolution, empowering businesses with cutting-edge solutions and a dedication to innovation. This blog explores the advantages QR codes offer businesses, addresses lingering concerns, and provides actionable steps to seamlessly integrate them into your operations.

What Is a QR Code?

A QR code, or Quick Response code, is a matrix barcode featuring a pattern of black-and-white squares that store and retrieve data when scanned by devices like smartphones or tablets. Originally used for tracking parts in vehicle manufacturing, QR codes have evolved into versatile tools across industries.

Unlike traditional barcodes, QR codes store information horizontally and vertically, allowing them to encode diverse content such as website URLs, contact details, encrypted messages, or payment information.

The surge in QR code popularity is fueled by simplicity, touch-free convenience, and diverse applications across retail, marketing, and events. Security features and seamless device compatibility further solidify its value.

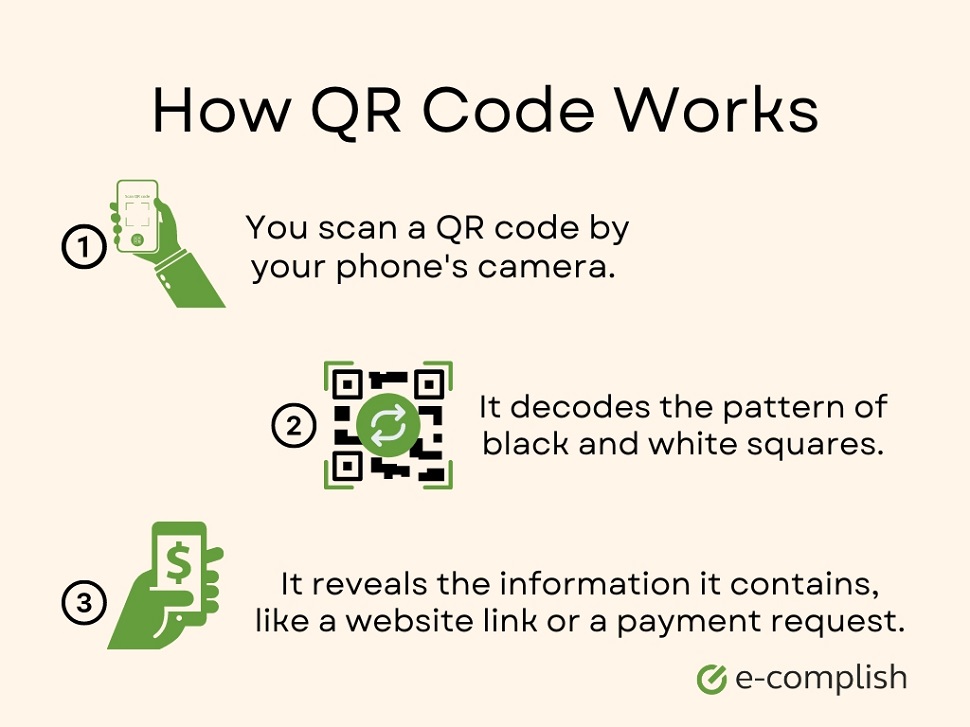

How Does a Payment with a QR Code Work?

When customers scan a QR code with their smartphone camera and a QR code reader app, the camera takes a picture. The app then analyzes this image, deciphering the pattern of black-and-white squares to unlock the hidden information encoded within. Upon scanning the QR code, the customer is directed to a secure payment page or app. This page will display the transaction amount for confirmation.

Depending on the system, customers might need to enter a PIN or select their preferred payment method, such as a linked bank account or digital wallet. After verifying the details, a simple confirmation on their part finalizes the transaction. This initiates a secure funds transfer from the customer’s account to the vendor’s.

Once the payment is processed, the vendor will typically send a digital receipt or confirmation directly to the customer’s smartphone, serving as a permanent record of the completed transaction.

Types of QR Codes

Payment with QR codes comes in two main varieties: static and dynamic. Choosing the right type depends on what information you want to convey and how much flexibility you need.

Static QR Codes

A static QR code is one in which the encoded information remains fixed once generated. This means the content, such as a URL or contact details, is embedded directly into the QR code during creation and cannot be altered later. These codes are best for one-time purposes, such as sharing contact information or linking to a website where the data does not need updating.

Static QR codes do not offer tracking capabilities or analytics, which makes them straightforward to generate and use without additional software. Their static nature enhances security since the encoded data cannot be modified or redirected, ensuring reliable information retrieval for users scanning the code.

Dynamic QR Codes

A dynamic QR code functions differently from its static counterpart by using a short link to direct users to a web address or data rather than embedding information directly in its pattern of black and white squares. This link can be updated anytime, even after the QR code has been printed or displayed, offering unparalleled flexibility.

It’s ideal for scenarios where information needs frequent updates, such as changing restaurant menus, updating event details, or revising product promotions. Dynamic QR codes also provide robust tracking capabilities, allowing users to monitor scan counts and geographical data.

Main Benefits of QR Code Payments

QR codes have various applications. From a payment processing perspective, contactless payments with QR codes reduce physical contact and enhance customer convenience in industries ranging from retail and hospitality to healthcare and transportation.

| Business Type | Benefits of QR Code Payment Systems |

|---|---|

| Retail Stores | Faster checkout; Increased sales; Improved customer experience; Lower transaction fees. |

| Restaurants & Cafes | Streamlined ordering & payment; Reduced wait times; Contactless service. |

| Hotels & Resorts | Mobile check-in/out; In-room payments; Enhanced guest experience. |

| Healthcare Providers | Simplified bill payment; Secure online payments; Improved efficiency. |

| Event Organizers | Ticketless entry; Mobile ticketing & payments; Contactless concessions. |

| Transportation Services | Contactless fare payment; Automated ticketing; Improved passenger experience. |

| E-commerce Businesses | Simplified checkout; Mobile-first payments; Increased customer engagement. |

#1. Convenience and Speed

A quick scan with a phone and your customers are done! This simplicity benefits both them and you. Long checkout lines have become a thing of the past, and online ordering gets a major upgrade — a single scan finalizes purchases in seconds. Already 58% of consumers say they want to use a QR code at restaurants and grocery stores.

#2. Enhanced Security

QR code payments ensure security through encryption and tokenization. Encryption protects sensitive data by scrambling it during transmission, making it unreadable to unauthorized parties. Meanwhile, tokenization replaces account details with unique digital tokens, minimizing the risk of compromise even if intercepted.

#3. Increased Accessibility

The versatility of QR codes offers seamless integration into various platforms, from in-store checkout lines to online ordering systems and mobile wallets. This technology empowers a wider audience to participate in the digital payment landscape. E-Complish recognizes this power and provides solutions that cater to diverse customer bases.

#4. Cost-Effectiveness

Compared to traditional payment methods, QR code systems often have lower processing fees, translating to direct cost savings. Additionally, the swiftness of QR code transactions reduces overall transaction times, boosting efficiency and allowing businesses to serve more customers. E-Complish understands this value.

QR Code Payment Solutions: E-Complish

If you need a QR code for payment, E-Complish can help. Our E-Cash platform and E-Wallet work seamlessly together, providing user-friendly interfaces, smooth integration, and comprehensive support.

E-Cash Platform

E-Complish’s E-Cash payment system is different from your typical digital currency. It bridges the gap between traditional cash and the convenience of online payments.

Here’s how it works: customers can choose E-Cash at checkout instead of needing a credit card or bank account. This generates a unique QR code that is sent to their phone or computer. They can then use their device or print the code and head to a nearby E-Cash location. There, a quick scan and a cash payment settle the bill.

To this end, E-cash keeps the familiarity of cash while offering the ease of online transactions for those who prefer cash or lack access to traditional banking.

Advantages of E-Complish’s E-Cash Platform

- Expands customer reach: Attract new customers who prefer cash or need access to traditional banking methods.

- Increased payment options: Offer greater flexibility to your customers with the familiar comfort of cash payments.

- Simplified reconciliation: Manage all payments electronically through a secure portal, even for cash transactions.

- Convenience for customers: Pay bills, shop online, or make donations using cash at nearby E-Cash locations.

- Enhanced security: Benefit from E-Complish’s dependable and PCI-compliant payment processing solutions.

Digital Wallet

E-Complish’s digital wallet solution lets customers store credit cards, debit cards, and bank accounts all in one place. This secure app enables effortless online payments and on-the-go purchases, integrating with popular services like Apple Pay, Google Pay, and their own E-Complish E-Wallet. But it doesn’t stop there.

We go beyond providing direct money transfers between bank accounts for a truly unified payment experience. Thinking of accepting payments? E-Complish empowers businesses too. Our platform lets you track transactions, issue gift cards and loyalty vouchers, and accept payments through various methods, including POS systems, QR codes, and NFC.

Advantages of E-Complish’s Digital Wallet

Benefits for businesses:

- Increased customer satisfaction through seamless payment experiences.

- Expanded reach by accommodating global customers with diverse payment preferences.

- Streamlined transactions for faster and more efficient operations.

Benefits for customers:

- Convenience in managing multiple payment methods easily.

- Enhanced security with encrypted data for safer transactions.

- Global access to make and receive payments internationally.

- Reduced fees compared to traditional banking and card services.

- Speedy transactions with instant transfer capabilities.

- Seamless integration with local vendors for various utility payments and services.

Ultimately, E-Complish’s digital wallet makes payment processing easier for businesses and customers. Businesses can streamline operations, optimize payment processes, and attract a wider audience while customers enjoy a secure, convenient, and feature-rich payment experience.

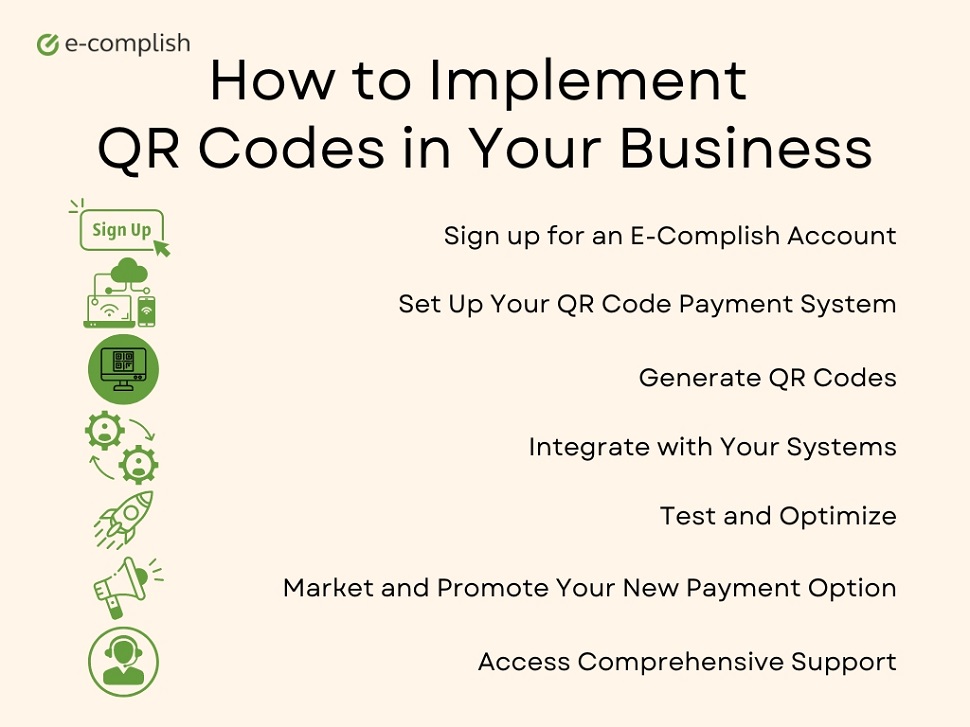

QR Code Payments for Your Business: Step-by-Step Guide

Simplify payments and empower your customers with E-Complish, your trusted QR code partner! We offer QR code payments for businesses that integrate with your existing systems.

Step 1. Sign Up for an E-Complish Account

Contact us via email, chat, or phone to generate a support ticket, which includes a unique ID sent to your email. Upon responding to this email, our team will guide you through creating your client profile.

Step 2. Set Up Your QR Code Payment System

E-Complish’s platform integrates with various payment gateways, allowing you to choose the best fit for your business. Once connected, configure payment processing details and customize the QR code with your branding for a professional touch. Our support team offers personalized guidance on setting up your system for a smooth and successful launch.

Step 3. Generate QR Codes

Our QR code generator transforms your information (text, website, or payment details) into a black-and-white checkered pattern. It first converts your data into a format suitable for the code, then strategically arranges it within a grid, adding special patterns around the edges for easy scanning.

Step 4. Integrate with Your Systems

E-Complish seamlessly integrates with your existing tools! Our QR code solution works with POS systems, websites, and mobile apps. Simply follow our step-by-step guide to generate unique QR codes and embed them effortlessly into your preferred platform. This allows your customers to scan and pay instantly.

Step 5. Test and Optimize

We encourage you to test your codes thoroughly across different devices and lighting conditions. Refine size, placement, and error correction for optimal scannability. Addressing any issues before launch is important to ensure a positive user experience and maximize customer satisfaction.

Step 6. Market and Promote Your New Payment Option

Effective marketing is key to attracting customers to this speedy payment option.

- Display QR codes prominently: Place them on signage, product displays, and marketing materials to ensure clear visibility.

- Leverage social media: Promote the convenience and security of QR code payments on your social media platforms to build awareness and excitement.

- Offer incentives: Entice customers with discounts or promotions for using contactless payments. This jumpstarts adoption and reinforces the benefits.

Step 7. Access Comprehensive Support

Integrating QR code payments with existing point-of-sale systems can be complex and require technical expertise, which is why E-Complish offers comprehensive support every step of the way. Our dedicated team is here to answer your questions, troubleshoot any technical hiccups, and guide you towards a seamless QR code payment experience for you and your customers.

Streamline the Contactless Payments with E-Complish Solutions!

From the lightning-fast convenience for customers to the robust security features protecting transactions, QR codes provide a safe and secure way to accept payments. Additionally, payment with QR codes broadens your customer base, and their cost-effectiveness can improve your bottom line.

E-Complish, a leader in QR code payment solutions, is dedicated to innovation and customer satisfaction. We offer a user-friendly platform and expert guidance to ensure a streamlined integration with your existing systems. As QR code payments continue their meteoric rise, positioning your business at the forefront of this technology is a smart move.

Explore the possibilities at E-Complish and reach out to our sales team today to discuss a customized solution for your business.

Table of Contents

Table of Contents