Updated by 11.25.2025

What’s an ACH Payment & How Do You Make One: The Complete Guide

ACH payments allow customers and businesses to transfer money between banks without relying on paper checks, wire transfers, credit card networks, or cash. They’re quick, convenient, and cost-effective.

According to NACHA, ACH payments experienced a 13.7% increase, reaching $791.95 billion by the end of 2025. While ACH payment processing may seem daunting to you, they’re fast becoming the preferred payment option.

For this reason, this guide answers pertinent questions like “What does ACH stand for?” and explains the fundamentals of ACH transfers and payments, providing you with the necessary knowledge and confidence to implement this efficient payment method in your business.

What Is an ACH Payment?

An ACH payment (Automated Clearing House) is an electronic payment made through an Automated Clearing House Network. It is most commonly used for direct deposits (like an employer distributing payroll) and customer collections.

So, what’s the difference between ACH transfers and ACH payments? ACH payments refer specifically to electronic payments made to pay a bill or invoice, while ACH transfers are broader, referring to any movement of funds between two bank accounts.

To initiate an ACH payment, customers must provide authorization through a signature on an ACH authorization form or by agreeing verbally on a recorded call. Your bank account will then electronically pull the agreed-upon payment from the customer’s account.

What Is an ACH Transaction Network?

The ACH Network is a financial institution that facilitates the electronic transfer of funds between consumers, companies, and other financial institutions. It stands for Automated Clearing House and is used for various types of payments, such as direct deposit, payroll, and payment processing.

This electronic payment network is operated independently by the National Automated Clearing House Association (NACHA), which uses a secure network to facilitate the transfer of funds over the Internet and is one of the most popular forms of electronic payment used in the United States.

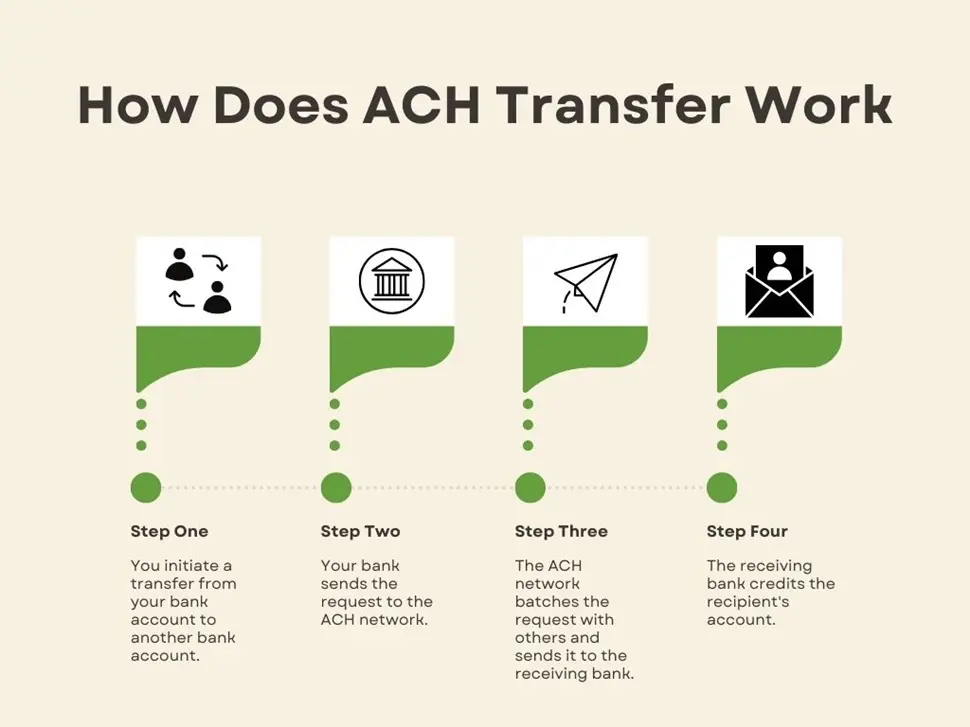

How Does ACH Work?

Funds are transferred between the sending and receiving institutions, which both have to be members of the ACH network. The institution must verify the information to complete the transaction and send it to the correct individual or organization.

Once the verification is complete, the receiving institution accepting ACH payments processes the request and makes any necessary changes to complete the transaction.

How Long Does an ACH Transfer Take?

The ACH payment process typically takes one to two business days, making it a fast and reliable method of sending funds. However, it is possible to initiate same-day ACH payments as well.

However, bounced payments, which occur when a customer’s account doesn’t have sufficient funds, can often cause complications. Like paper checks, ACH payments and transfers will only go through with the necessary money in the payer’s bank account.

ACH payments are also not the same as debit and credit card payments. An ACH credit transaction is initiated by the sender of funds, such as a bank, whereas the receiver of funds initiates ACH debit transactions. The bank receives a payment request from the payee and sends the funds by that request.

A Closer Look at the Types of ACH Transactions

ACH transactions are divided into two types: ACH credits and ACH debits, depending on the direction of the money flow.

ACH Credit

An ACH credit is when a payer “pushes” money from their bank account to a payee. It’s a digital version of a paper check, as both the payer and payee must authorize the transaction.

How it works:

- The payer provides their bank account information to the person or business they’re paying, including their routing and account numbers.

- The business initiates a request for funds from the payer’s bank.

- The money is transferred from the payer’s bank account to the payee’s bank account.

ACH Debit

In contrast, an ACH debit is when the payer allows the payee to withdraw money from their account. In other words, it is a payee’s request for the ACH network to “pull” money from an account they don’t control.

How it works:

- Either the payer gives the payee an authorization form, or the payee sets up the electronic funds transfer on their side.

- The payee has an online portal where the payer adds their banking information and authorizes ACH debit payments.

A Breakdown of the ACH Categories

ACH direct deposits are used for depositing funds, while ACH direct payments are used for making payments. They are utilized differently by governments, businesses, and individuals to make electronic payments.

ACH Direct Deposits

Direct deposits are ACH credit payments made into a consumer’s checking or savings account from a federal or state agency or employer. Governments and businesses rely on the ACH network to distribute these critical payments to millions of people securely.

ACH payments are cheaper than wire transfers and card payments and ideal for recurring, high-volume transactions. They also reduce the risk of fraud and lost or stolen checks, ensuring money is transferred to the right people.

The most common types of ACH direct deposits include:

- Payroll payments

- Tax refunds

- Social Security

- Social Security Disability Insurance (SSDI)

- Dividend payments

- Interest payments

- Annuity payments

- Insurance claim payments

ACH Direct Payments

ACH direct payments are ACH debit payments involving a person, business, or organization transferring money from their bank account to another. Whoever makes the payment will notice an ACH debit in their bank account, indicating who the money was sent to and how much.

These payments can be one-time or recurring. In the latter case, the payer only has to provide their details once and enter a regular debit payment agreement with their bank, whether monthly, quarterly, semi-annual, or yearly.

This type of ACH transaction is used for a variety of purposes, including:

- Bill payments like utilities, and subscriptions (Netflix).

- Peer-to-peer (P2P) payment apps.

- Consumer-to-consumer (C2C) payments.

- Business-to-business (B2B) payments.

- Certain government payments like child support and tax refunds.

Why Is ACH a Great Choice for Businesses and Consumers?

Using ACH for businesses and consumers maximizes savings, security, and convenience. It’s a win-win for both parties, which leads to simplified accounting and better customer service. And, because ACH payments are based on bank accounts and not card numbers, there are far fewer payment failures.

ACH for Businesses

- Lower fees: Payment fees average at $0.12-0.55 per transaction compared to credit card fees that are between 1.5% and 3.5% or wire transfers, which can cost $35 to $50.

- Better collections: Setting up recurring or automatic payments makes it easier for customers to make timely payments, improving cash flow.

- Time-saving: Expedite payments in as little as one business day if needed.

- Faster settlements: Directly transferring funds between bank accounts reduces processing time.

ACH for Consumers

- Online convenience: Quickly and conveniently pay utility bills and mortgages or transfer money to family or friends from phones, tablets, or computers.

- Reduced expenses: Similar to businesses, ACH payments are less expensive for consumers than card payments or wire transfers, and service fees aren’t usually charged.

- Time and effort savings: Schedule one-time or recurring payments in advance for easy budget management.

Universal Benefits

- Low fraud risk: ACH payments use advanced encryption techniques such as tokenization and multi-factor authentication to protect sensitive financial information during transmission.

- Fund recovery: Account holders can stop, reverse, or recover funds lost to fraud or error within 90-120 days.

- Paperless: Eliminate paper checks, envelopes, and postage that cause deforestation and global warming.

Cons of ACH Transactions

- Maximum payment limits: Many financial institutions restrict the frequency and amount of ACH transfers, with separate limits for deposits and withdrawals.

- Settlement time frames: Clearing houses send requests to ACH operators at specific times, so payments initiated after the scheduled time may be delayed. Payments can take up to three days or more to clear on bank accounts.

How to Make ACH Transactions

Step 1: Set Up Your ACH Account

The process for creating an ACH account in E-Complish is straightforward. The first step is to gather the necessary documentation, including personal information, bank account information, and a valid government-issued ID.

Step 2: Verify Bank Account Information

Verifying bank account information is essential to ensure successful ACH transactions. This involves submitting bank routing and account numbers to our platform for verification. E-Complish’s platform will then compare this data with the information provided by the ACH Originating Depository Financial Institution (ODFI). Any discrepancies will be flagged for further analysis. We also encourage customers to contact their banks to ensure accuracy.

Step 3: Set Transaction Parameters

Setting transaction parameters allows you to establish and customize each transaction according to your needs. For instance, businesses can set transaction limits to ensure that payments stay within a designated amount, enforce an approval process to track ACH payments and establish scheduling options to define when payments should go through.

Every business is different, so having the flexibility to set transaction parameters according to their specific requirements gives organizations the control they need to execute successful payments through E-Complish.

Step 4: Initiate ACH Transactions

When initiating ACH transactions through E-Complish, you can input the necessary recipient information, including name and banking information, as well as the amount of the transaction and its purpose. The software then automatically encrypts the data, transforming it into a secure file that banks recognize.

From there, the business can send the file to its financial institution for fast processing – often within the same business day. The convenience and speed of initiating ACH transactions through E-Complish make it an ideal option for businesses looking to improve the efficiency of their payment process.

Step 5: Monitor and Manage ACH Transactions

Our cutting-edge tools and features let you track, report, and reconcile ACH transactions in real-time, allowing you to stay on top of your finances. This helps you monitor and respond to merchant payments, detect errors, and reduce the risk of fraudulent transactions and other incidents.

Comparison with Other Payment Methods

Compared to other payment methods, such as wire transfers, credit cards, and checks, ACH transactions are relatively inexpensive and faster. For example, ACH payments are often settled the next business day, while wire transfer payments can take multiple days or longer.

On the other hand, there can be some drawbacks to using ACH transactions. For example, some have argued ACH transactions require manual entry of payment information, consequently increasing the chance of errors.

Furthermore, transfer limits, receipt time, and non-guarantee of payment exist for some banks. As such, it is important to understand your particular financial institution’s provisions when forgoing ACH transactions compared to other payment methods.

ACH Transfer vs. Wire Transfer

As with most payment methods, there are pros and cons when it comes to ACH transactions vs wire transfers:

- Speed: ACH transfers take a few business days, excluding weekends and holidays, as they are processed in batches seven times daily. Wire transfers offer almost immediate fund transfers with real-time processing, with no hold on received funds.

- Limits: ACH payment limits are usually $100,000, while wire transfers are $500,000. The ACH network also only operates with US-based bank accounts, prohibiting international payments.

- Cost: Local wire transfers cost up to $35, with international reaching as high as $50, whereas ACH transfers are only a few dollars.

- Disputes: Unlike ACH payments, wire transfers are final once delivered to another bank account and cannot be reversed.

- Convenience: ACH payments are more convenient since they can be done online or through a mobile app, while wire transfers involve visiting a bank branch or calling a representative.

- Security: Both methods are safe. However, wire transfers are marginally more secure due to the lack of reversal options, reducing fraudulent paybacks.

Streamline Your Payment Processes with E-Complish

ACH payments are cost-effective, convenient, and safe, allowing the secure transfer of money from one person, business, or organization to another. Now that you understand the basics, your business can benefit from significant savings and improved payment efficiency.

And E-Complish’s ACH Payment Processing Solutions only cost $0.10 per transaction! Contact us today to learn how we can streamline your payment processing and improve customer satisfaction with ACH payments.

Frequently Asked Questions

Are ACH transactions secure?

Yes, ACH transactions are secure. Multiple layers of encryption and authentication protocols ensure that all ACH transactions are protected with the utmost security. Industry-standard security protocols and measures, such as tokenization, Transport Layer Security (TLS), and Encryption Standard (AES), are used to protect sensitive financial information during ACH transactions.

Can I cancel or reverse an ACH transaction?

Yes, you can reverse ACH transactions. For recently initiated transactions, you may request a same-day reversal from your financial institution. For transactions settled more than one business day ago, the Federal Reserve provides an adjustment process for you to request corrective entries. In limited circumstances, requesting a credit or debit transaction return within 60 days of the settlement date may be possible.

Table of Contents

Table of Contents