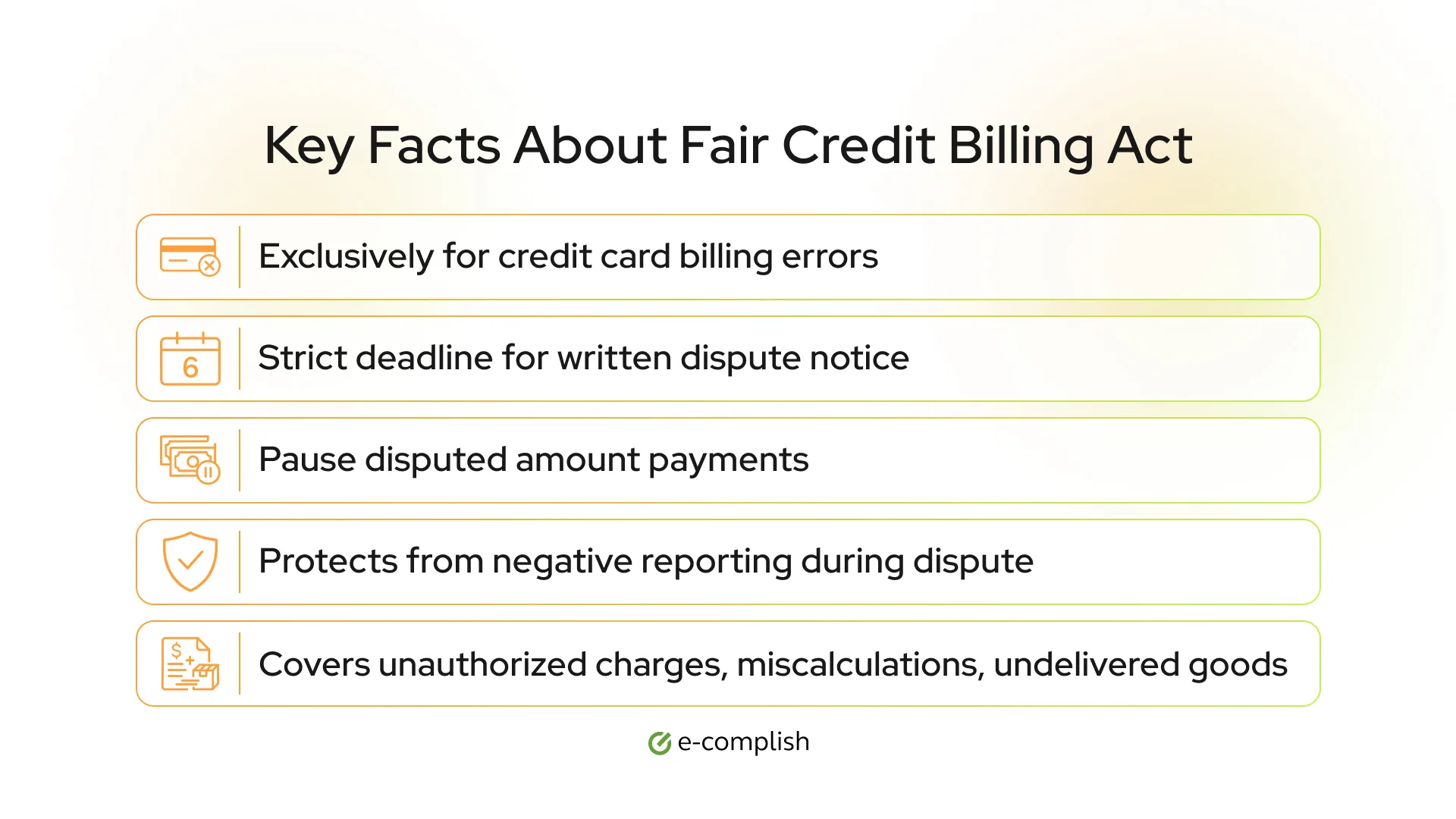

- Charges they didn't authorize, like fraud or theft

- Incorrect amounts or wrong dates on their statement

- Charges for goods or services they didn't receive or that weren't delivered as promised

- Calculation or accounting errors by the creditor

- Failure to send their billing statement to the correct address

- Charges they've asked the creditor to explain or provide proof for

Updated by 07.29.2025

What Is the Fair Credit Billing Act (FCBA) & How It Benefits Consumers

Did you know that chargebacks cost merchants over $30 billion annually in lost revenue, fees, and operational expenses?

Billing disputes can quickly spiral out of control. Whether you’re a frustrated customer or a merchant trying to resolve a conflict, the process often feels chaotic. The Fair Credit Billing Act (FCBA) establishes a framework for addressing this chaos. It protects consumers while giving merchants a clear roadmap for handling disputes fairly.

Understanding the Fair Credit Billing Act definition helps you cut down on expensive disputes and keep your customers happy.

This blog covers what you need to know about the Fair Credit Billing Act and why it matters for your business. Plus, discover how the right chargeback management tools can make dispute resolution much simpler.

We’ll walk you through what the Fair Credit Billing Act does and why it matters for your business. We’ll also cover how the right chargeback management tools can make this whole process much easier.

What Is the Fair Credit Billing Act?

The Fair Credit Billing Act (FCBA) is a federal law enacted in 1974 that protects consumers from unfair billing practices and provides essential safeguards for credit card transactions. Considered a landmark legislation, it sets out clear guidelines for how credit card companies must handle billing disputes and errors. As a merchant, understanding the FCBA is important because it directly affects how you deal with customer disputes and chargebacks.

Understanding the FCBA

The FCBA’s structured dispute process can affect your business operations. When customers dispute charges, they have 60 days from their billing statement to report errors in writing. Credit card companies must acknowledge disputes within 30 days and resolve them within 90 days.

During this investigation period, you may face temporary revenue holds. If the dispute is found in the customer’s favor, you’ll lose both the sale and potentially incur chargeback fees. Understanding these timelines helps you prepare for potential revenue impacts and maintain proper documentation to defend legitimate charges.

Key Factors Behind the FCBA’s Creation

Three major issues in the credit card industry led to the creation of the FCBA:

- Consumer protection: As more people started using credit cards in the 1960s and 1970s, billing mistakes and fraud became common problems. Customers had few options to fight back against these issues. The FCBA was created to protect people from these financial problems and make sure they wouldn’t have to pay for charges they didn’t incur.

- Dispute resolution: Before the FCBA, consumers had no standardized method for challenging questionable charges. The Act established a structured, time-bound process that requires creditors to investigate disputes within specific timeframes and communicate their findings clearly to cardholders.

- Industry standards: The legislation created uniform practices across the credit billing industry, ensuring that all creditors follow the same fair procedures when handling billing disputes, thereby leveling the playing field for both consumers and businesses.

Your payment processor should handle regulations, not dump them on you. E-Complish takes care of FCBA compliance automatically, from dispute timelines to proper documentation. Turn chargeback compliance into a competitive advantage: get a demo now.

How Does the Fair Credit Billing Act Work?

Understanding how the FCBA protects you is just as important as knowing why it exists.

- Dispute process: Consumers have 60 days from the date they receive their billing statement to send a written dispute letter to the creditor. This letter must include the consumer’s name, account number, a description of the error, and the disputed amount. It’s recommended that they send this letter via certified mail with a return receipt requested to ensure proof of delivery. As a merchant, you may be contacted by the credit card company during this process.

- Coverage scope: The FCBA protects consumers from unauthorized charges, incorrect amounts or transaction dates, charges for undelivered goods or services, and payment crediting errors. These disputes can result in chargebacks that directly impact your revenue. Note: The Act does not cover quality disputes about products or services you received.

- Creditor responsibilities: Upon receiving the dispute, the creditor must acknowledge it within 30 days and complete an investigation within 90 days. During this time, the consumer is not required to pay the disputed amount, and the creditor cannot report it as delinquent. If the creditor finds an error, they must correct it; if not, they must provide a written explanation for why the bill is correct. Meanwhile, merchants may face temporary holds on their funds and be required to provide supporting documentation.

The FCBA works, but compliance isn’t simple. Between tracking deadlines, managing documentation, and handling investigations, most businesses need help staying on top of it all. This is where having the right payment processing partner makes all the difference.

Fair Credit Billing Act Benefits and Protections to Consider

The FCBA gives consumers powerful dispute rights, but it also has built-in limitations that work in your favor.

Benefits of FCBA Protection

The main advantages of FCBA protection include:

- Error protection: Safeguards consumers against billing mistakes such as duplicate charges, incorrect amounts, or computational errors made by creditors.

- Fraud defense: Limits consumers’ liability for unauthorized use of their credit accounts, protecting them from fraud and identity theft. Consumers are only responsible for up to $50 in unauthorized charges, and many card issuers waive even that amount.

- Quality disputes: When consumers are billed for goods or services that are defective, undelivered, or not as promised, the FCBA allows them to dispute those charges and withhold payment while the issue is investigated.

- Investigation rights: Creditors must promptly acknowledge disputes (within 30 days) and complete a fair investigation (within 90 days). During this period, consumers are not required to pay the disputed amount, and creditors are prohibited from reporting it as delinquent.

These protections create a safer credit environment, giving consumers peace of mind and a straightforward process to resolve billing issues fairly. Don’t let FCBA compliance become a burden for your business. Get a demo now and discover how E-Complish handles regulatory requirements so you can focus on growth.

FCBA Limitations and Requirements

Like any law, the FCBA also has limitations:

- Time limits: Consumers have a strict 60-day window from the date the creditor mails the billing statement containing the error to send a written dispute. Missing this deadline can forfeit the right to dispute the charge under the FCBA.

- Written requirements: Disputes must be submitted in writing — a phone call alone is not enough (except for reporting lost or stolen cards). The written dispute should include relevant details and be sent to the creditor’s designated billing inquiry address, preferably via certified mail for proof of delivery.

- Coverage scope: The FCBA does not cover disputes related to the quality of goods or services or issues with installment loans and debit cards.

- Good faith requirement: Consumers are expected to make disputes in good faith. Frivolous or fraudulent disputes may lead to loss of protections and potential legal consequences.

In summary, the FCBA provides strong protections against billing errors and unauthorized charges. However, consumers must act quickly and follow specific procedures. They need to submit proper written disputes within strict deadlines and understand exactly what the law covers to ensure their rights are protected.

How the Fair Credit Billing Act Differs from Other Consumer Protections

While other consumer protection laws like the Fair Credit Reporting Act deal with credit reports and the Truth in Lending Act covers loan disclosures, the Fair Credit Billing Act (FCBA) gives consumers a straightforward process to dispute billing errors and unauthorized charges on credit cards, store charge cards, home equity lines of credit, and other revolving credit accounts.

| Feature | Fair Credit Billing Act | Truth in Lending Act | Fair Debt Collection |

|---|---|---|---|

| Purpose | Billing dispute resolution | Credit disclosure requirements | Debt collection practices |

| Scope | Credit billing errors | All credit transactions | Debt collection activities |

| Time Limits | 60 days to dispute | Various disclosure timelines | Ongoing protections |

| Resolution | Structured investigation process | Disclosure compliance | Harassment prevention |

| Coverage | Open-end credit accounts | All consumer credit | Third-party collectors |

| Remedies | Error correction, credit restoration | Damages for violations | Cease communication rights |

| Requirements | Written dispute letters | Truth in advertising | Validation of debts |

| Enforcement | Federal banking regulators | Multiple agencies | FTC and state authorities |

If you’re dealing with billing disputes or worried about fraud, E-Complish has chargeback tools that can make your life easier. Our solutions help you stay compliant with the Fair Credit Billing Act and resolve disputes more smoothly, so you can handle credit transactions with peace of mind.

E-Complish — Your Trusted Partner in Payment Processing

Dealing with Fair Credit Billing Act compliance doesn’t have to stress you out. At E-Complish, we understand: you need payment processing that works smoothly while keeping you compliant with consumer protection laws.

Our platform processes over $3 billion in transactions annually. We’ve got everything from dispute management to fraud prevention covered, with over 70% chargeback win rates and 25 years of proven results.

Whether you’re just getting started or looking to upgrade your current system, we’ll work with you to find solutions that fit your needs. Our clients see measurable results, like 80% increases in online payments and 15% decreases in delinquencies.

Make payment processing a competitive advantage. Reach out to us for FCBA-ready solutions.

Table of Contents

FAQs

What types of billing errors does the Fair Credit Billing Act cover?

How long do I have to dispute a billing error under the FCBA?

Can the Fair Credit Billing Act help with unauthorized charges on my account?

Table of Contents