Table of Contents

Updated by 01.15.2025

Everything You Need to Know About ACH Authorization Form Requirements

ACH authorization forms enable businesses to collect payments through the Automated Clearing House network. They offer a secure, efficient payment method for customers while protecting businesses from fraud and chargebacks.

ACH authorization allows direct fund transfers between bank accounts, reducing errors and delays associated with manual payments. This method saves businesses time and money by eliminating manual processing and lowering processing fees.

This blog covers essential ACH authorization form requirements, including how to complete them correctly for smooth payment processes. If you’re looking to implement ACH payment solutions for your business, understanding these requirements is important.

What Is an ACH Authorization Form?

An ACH authorization form, also known as an ACH payment form or an Automated Clearing House form, is a legally binding agreement outlining payment terms between a payor and payee for bank-to-bank transfers via the ACH network, as established by the National Automated Clearing House Association (NACHA).

The form requires you to provide your bank account information, including routing and account numbers, allowing the third party to initiate direct deposits or debits.

This legally binding contract grants ongoing access to your bank account. Unlike other methods, ACH debits can be initiated by the payee after receiving customer authorization.

This ensures businesses receive payments as agreed without waiting for customer-initiated transactions. ACH is suitable for companies collecting recurring payments.

Why Are ACH Authorization Forms Important?

ACH authorization forms are important for several reasons:

- They ensure that businesses comply with NACHA (National Automated Clearing House Association) rules and regulations.

- They help protect both businesses and customers from unauthorized transactions.

- In case of payment disputes, these forms serve as evidence of the customer’s consent.

- They allow businesses to initiate payments without waiting for customer action, streamlining the payment process.

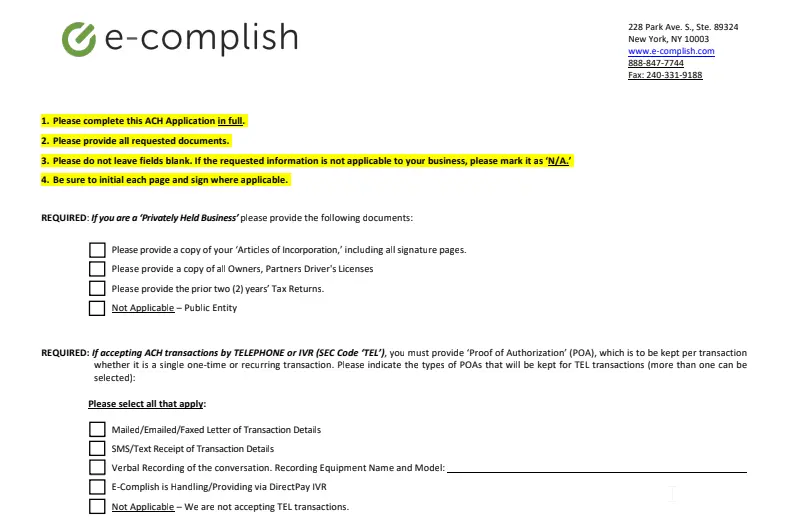

What Information Do You Need for an ACH Authorization Form?

An ACH authorization form must include specific information to comply with NACHA Operating Rules and ensure proper processing of payments. Here are the key elements required:

- Personal information: Full name, address, phone number.

- Bank account details: Account number, routing number, account type (checking or savings).

- Payment information: Payment amount (or maximum amount for variable payments), payment frequency (one-time or recurring), and start date of authorization.

- Payee details: Name of the company or individual being paid.

- Authorization statement: A clear statement such as “I authorize Company A to debit my account”.

- Signature: Your signature (or electronic equivalent for online forms).

- Cancellation parameters: Instructions for canceling recurring payments or payments scheduled in advance.

This information allows the payee to process ACH payments from your account as authorized. Always ensure all details are accurate before submitting the form.

Additional NACHA Requirements for ACH Forms

Additional requirements for a compliant ACH authorization form include:

- Payer’s permission: A clear request for authorization from the payer for all future debits, including amount and frequency.

- Banking details: Collection of necessary account information for payment submission.

- Revocation instructions: Clear explanation of how customers can revoke their authorization, including any required notice period.

- Form of authorization: Whether it’s a paper form, online agreement, or recorded verbal authorization.

- Record retention: The requirement to keep the authorization on file for at least two years after the last authorized payment.

While there’s flexibility in how you present this information, ensuring all these elements are included is crucial for compliance with NACHA rules and for protecting both your business and your customers in ACH transactions.

Stop Struggling with Complex ACH Payments!

Try E-Complish's ACH payment solutions! Experience the benefits of our ACH payment system with our demo version.

Common Errors and How to Avoid Them

When dealing with ACH authorizations, businesses often encounter these common errors:

- Incomplete authorization forms: Ensure all required fields are filled out correctly. Use form validation to prevent submission of incomplete information.

- Incorrect account information: Double-check account and routing numbers. Consider implementing a verification process to confirm account details.

- Failure to obtain proper authorization: Always obtain explicit authorization before initiating ACH debits. Keep clear records of all authorizations.

- Ignoring revocation requests: Process cancellation requests promptly. Have a clear process for handling revocations and communicate it to customers.

- Insufficient funds errors: While not entirely avoidable, you can minimize these by scheduling debits on optimal days (e.g., after common paydays) and communicating clearly with customers about upcoming debits.

By being vigilant about these common pitfalls and implementing proper checks and balances, businesses can significantly improve the accuracy and effectiveness of their ACH payment processes.

How to Fill Out the ACH Authorization Form Correctly

Filling out an ACH authorization form is necessary to transfer funds electronically. It is essential to ensure the accuracy of the information provided. There are three primary ways to fill out an ACH authorization form: paper, phone, or online. Each method offers advantages, and choosing the most convenient approach for the user is essential.

Online Authorization

Online ACH authorization forms have become increasingly popular due to their convenience and efficiency. The process typically involves:

- Inputting account details (account holder name, account number, routing number, account type).

- Verifying identity through instant bank verification or micro-deposits.

- Providing a digital signature.

Aside from a signature, all other core requirements remain the same to complete an online ACH authorization form. However, validating the submitted bank information is an extra step to mitigate fraud and the risk of someone entering the wrong account details.

Once a customer has submitted an online ACH payment authorization form, you must provide written notification of the authorization, like paper-based authorizations. You can do this via email.

Here are two of the most popular methods for validating these details online:

Instant Bank Verification

The current trend in ACH payments is to use a third-party verification service to securely validate customers’ banking information by having them input their online banking credentials. Through this process, the third-party payment processor (TPPP) provides the financial institution with “read-only” access to the customer’s account details, which are verified.

Micro Deposits

Another way to verify the ownership of a bank account online is with micro-deposits. When someone completes an authorization online, the payee sends two small deposits to the payor’s bank account. These deposits, typically less than 10 cents, act as a “secret key” that the payor must correctly identify. If the payor identifies the correct deposit amount, they are verified as the owner of the bank account. Unfortunately, it takes one or two days to transfer the deposit.

Paper-Based Authorization

If your business interacts with customers in person, collecting paper authorization forms is often the easiest and most efficient way. The process includes:

- Completion of the form with accurate information.

- Signing the form.

- Keeping a copy for your records.

The layout of these forms can be standardized and must include the requirements we mentioned earlier. After completing the form, the customer should receive a copy, and the business must keep the original form for at least two years after the authorization has ended.

Authorization via Phone

Phone authorization is only permitted when the customer has an existing relationship with your business, defined as either a written agreement or the customer has purchased goods or services from you in the past two years. Importantly, the customer must initiate the call; “cold calling” for ACH authorization is not allowed.

When obtaining ACH debit authorization via phone, you need to:

- Obtain both verbal and written authorization for recurring payments.

- Record all phone authorizations for future reference.

Requirements differ for one-time and recurring payments:

- For one-off payments: Retain records of the authorization for two years after the agreement ends. This can be an audio recording of the authorization or a written notice sent before verbal confirmation.

- For recurring authorizations: Obtain both written and verbal authorization from the customer. The verbal authorization should be audio recorded and include clear, understandable terms that make it easily recognizable as an authorization.

By following these guidelines for each method, businesses can ensure they’re collecting ACH authorizations correctly and in compliance with regulations.

How Originators Prove That an ACH Debit Was Properly Authorized

Under NACHA Operating Rules, originators must retain an original copy or a copy of each consumer’s written authorization “or a readily and accurately reproducible record evidencing any other form of authorization.”

The documentation must show transaction details, such as consumer information and sales documentation that specifies what goods were exchanged or what services were provided to the consumer.

For instance, according to NACHA, some documentation can be captured in the form of a screenshot of the authorization language, along with two other items: a timestamp that indicates what date and time the consumer authorized the ACH debit and evidence of the consumer’s identity and consent to the debit transaction.

Managing ACH Authorization Forms

Once authorization is complete, you can manage ACH authorization forms outside the ACH network. To do so, the original authorization form must include instructions on canceling the authorization and the notice period required for cancellation.

Keep a Copy of the ACH Authorization Forms

An ACH agreement serves as a mutual understanding between the payor and payee. To ensure its validity:

- The payee must provide a copy of the agreement to the payor, regardless of the authorization method used (paper, online, or phone).

- The payee must retain a record of the agreement for two years after it is terminated or revoked.

These practices help maintain transparency and provide a reference point in case of disputes or audits.

How to Make Changes to ACH Agreements

If changes to the payment terms become necessary:

- The payee must give the payor ten days’ notice if the payment frequency or amount changes beyond what was initially agreed upon.

- If both parties agree to the change, they can expedite the timeline for the next payment.

This requirement ensures that payors are always aware of and agree to any modifications in their payment arrangements.

How to Revoke or Cancel ACH Debit Authorizations

When canceling or revoking ACH debit authorizations, it is essential to remember that legal payor and payee protections must be adhered to:

- Cancellation periods (e.g., how long the customer has to cancel an ongoing ACH payment).

- Notification periods (e.g., how much notice the customer must provide before canceling).

Your ACH debit authorization form must include details about how the payment can be withdrawn or revoked, such as by phone, form, or written request. If the request is received, you must cancel the ACH payment. You should also contact your bank to ensure the authorization has been canceled or revoked.

Make Your Payments Easier with E-Complish!

Digital payment services like ACH (Automated Clearing House) have become commonplace for many companies, and the pandemic has accelerated the shift to digital payments. Online ACH payments are desirable because they are contactless, fast, efficient, and secure.

Business owners, suppliers, and service providers must simplify their payment process to ensure they get more clients, leads, and customers while maintaining security and liability.

If you’re looking for state-of-the-art payment software, E-Complish can help. Our payment solutions accept all major card brands and ACH authorizations. Request a consultation to learn more about how E-Complish can save money and make your payment system more efficient.

Table of Contents

Frequently Asked Questions

How long is an ACH authorization valid?

Can a customer cancel an ACH authorization?

Are there different rules for business (CCD) and consumer (PPD) ACH transactions?

What happens if an ACH payment is returned or rejected?

Can I change the amount or date of an ACH payment after authorization?