Updated by 12.06.2024

Understanding the Credit Card Funding Cycle as a Merchant

It’s surprising that a lot of new merchants not to mention some veteran merchants are in the dark about how credit card processing works.

To them, the technology behind the way that they get paid (along with debit cards) by most of their customers most of the time is like magic. But when things don’t go as usual, getting tricked by “magic” can lead to many unwelcome moments of frustration, not to mention negative shocks.

If you’re a new or experienced merchant who signs on to be a client of ours here at E-Complish, we prefer that you know the so-called “secrets” of the way in which you get paid by credit card. We pride ourselves on our own expertise, and on keeping our clients well-informed.

In the main, there are three steps in the process of the money flowing from a customer paying by credit card to your actually getting paid (as in, money showing up in your merchant account). These steps are Authorization; Settlement; and, Funding. If you are utilizing batch processing, which we at E-Complish highly recommend (and most merchants do use), then there is a fourth step, which actually comes second in the whole process: Transmission. But it’s always the Authorization step that is the biggest and most important one of all of them.

Authorization simply means that a customer’s credit card information has been entered in an attempt to pay a bill or make a new purchase. It may be entered by a swipe or a “chip insert” in one of your physical locations. It might also be entered via your website, a smartphone, or the keypad on a ground-line telephone. When a credit card is being “authorized”, this just means that it’s being confirmed that it’s able to pay for the customer’s attempted transaction.

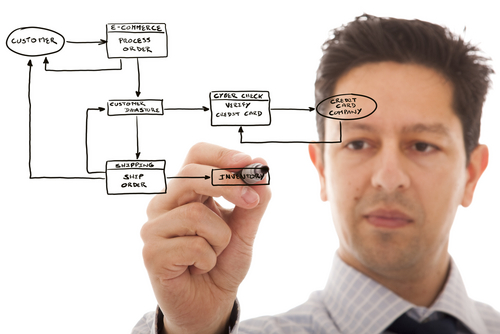

What happens at first with authorization is that once the card’s information is entered, it gets transferred to your payment processor (like, perhaps, E-Complish see us waving at you?). Next, the payment processor sends the information to the customer’s credit card provider (typically either Visa, MasterCard, Discover, or Amex). This entity is usually called the “credit card brand”. After that, the brand passes the payment request on to the customer’s issuing bank. That issuing bank decides whether or not to accept the payment request, and sends the decision back to the brand, which then passes it back to your payment processor. The processor then lets you know if the payment successfully was approved, declined, or some sort of error. Thanks to computers, this all happens in a matter of milliseconds.

Most of the time, fingers crossed, an authorization attempt is “approved”. Voila! You’re set to get paid in the very near future. (It’s important to note that it’s the issuing bank, not the cardholder or even E-Complish, who “approves” a card’s use.) But a card may also be “declined” or (even less often) “referred”.

If the credit card gets declined, you as a merchant aren’t told why. This is to protect a customer’s privacy. This also means that you’ve got no obligation to tell the customer why her card didn’t go through. But the possible reasons why a card gets declined are: the card’s credit limit has been maxed out; putting the payment through would exceed the remaining credit on the card; prior to authorization, the card has been reported as lost or stolen; or, the authorization process sparked a security safeguard.

The bottom line here, a declined card cannot be processed for funding back to you the merchant.

If the card status comes back as “referred”, this means that a further security step is necessary to complete the process of approval. It requires additional information either from the cardholder or you, the merchant. Your payment processor will facilitate the fulfillment of the referral request. A referral may be needed if: the card is being used abroad; approval would max out the card’s credit limit; or, there’s a red-flag hold put on by a security safeguard, which could be cleared to allow approval.

Once a card gets approved, the next step is a settlement. This is initiated by an approved card’s info going back yet again to your payment processor. The payment processor submits the approved card (digitally) to the brand for interchange, as well as for other processing fees that need to be paid.

Finally, there is funding. This is when you, the merchant, get paid by having money deposited into your account. It’s made possible when a customer’s brand card reimburses your payment processor, allowing the company to pay you. Funding can be expected within one to three business days (excluding bank holidays), after authorization and approval of a card, except for Amex, with which takes four to five business days on average. Amex takes longer to fund because the brand relies most of its revenues on financing fees instead of interest charges, so an extra layer of settlement is necessary. The terms “settlement”, “funding”, and “batching” sometimes get used interchangeably to refer to this final funding step.

As mentioned above, batch payment processing can save you money and funding wait time, thereby giving you better cash flow as a merchant. And when you own a business, what’s better than better cash flow and understanding exactly how you get paid? Schedule a consultation and learn more.