Updated by 11.23.2023

How to Resolve Late Utility Payment Problems

Customers who delay paying bills can undermine your government utility in various ways. Discover possible consequences and corrective actions that can increase on-time payments.

Reasons Punctual Settlements Are Important

Cash flow: When income arrives unpredictably or inconsistently, your company may be unable to pay its own bills on time. Your cash flow indicates your success better than your total revenue. Some firms that look lucrative on paper close due to cash-flow shortages.

Revenue reports: Prompt payments keep your books, especially month- and year-end reports, solvent. If you count submitted invoices as revenue before receiving money, your records will be inaccurate.

Reputation: Ignoring delinquent payments can harm your reputation while exposing your government works to future concerns. For instance, customers who are aware of your relaxed position might become more careless about meeting due dates, jeopardizing your cash flow even further.

Compounding setbacks: The above problems will worsen over time. Delaying a fix for clients’ undisciplined payment habits will just multiply your consequences. If customers realize they can postpone their utility payments, they’ll follow that pattern deliberately or unintentionally. As your monthly balance sheets suffer, predicting or charting your overall growth will become more difficult.

Ways to Boost Timely Transactions

Audit your billing process: Are you issuing monthly statements consistently? Do they define your terms, conditions, and past-due penalties clearly? How do various internal departments communicate? A regular two-step follow-up system will avoid ignored late payments. First, ensure that your documented plan makes sense. Does it include firm protocols? Or do employees just improvise? Second, train and confirm that staffers are adhering to your official procedures. Erratic actions can cause disappointing results. So, monitor invoices and overdue payments, addressing any problems.

Establish stricter late-payment terms: Decide how to penalize delinquent customers. If your state imposes a late-fee limit, follow that current law. Adding up to 10 percent should keep you under that restriction.

Offer more transaction methods and plans: Numerous circumstances may contribute to customers not paying you on time. Some might not have available funds. Due to various family/work/health issues or misplaced/overlooked invoices, others could forget to settle their bills early enough. Luckily, you can solve these and additional oversights by offering several payment plans. Determining late payment reasons will simplify devising appropriate solutions.

To help cash-poor customers, split big sums into three to four smaller transactions or coordinate installment paybacks. Recurring arrangements that remit full amounts automatically by due dates are great options for busy and forgetful people. E-Complish’s EDoc lets patrons receive and sign payment plan agreements electronically. They can enroll in our handy RecurPay online. It will charge their utility bills to their credit cards on time every month without their input, avoiding unwanted late fees.

You must acquire customer authorizations before processing their electronic payments for two reasons. First, you may need documents to prove that specific consumers gave permission for your utility company to charge their credit card accounts. Possible disputes range from patrons claiming they never authorized such disbursements to employees trying to steal clients’ identities. Second, various legal, contractual, and security mandates require obtaining consent with participants affixing their e-signatures to agreements.

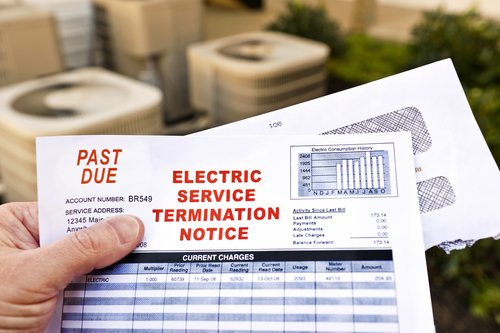

Issue warnings: Deliver formal notifications after customers exceed due dates by over a few days. Begin with emails giving clients friendly reminders about the payment methods you accept. If that’s ineffective, dispatch second-notice emails, then letters, and then phone calls. Warning patrons that you may initiate legal actions if they ignore your final notices could be necessary. Such statements can resolve forgetful clients’ innocent slipups by reminding them to expedite payments.

File lawsuits: If the above options are insufficient, consider seeking legal restitution. But small outstanding amounts might not warrant the money and time you’ll spend collecting compensations. Provide a lawyer with late payment information and discuss his recommendations.

To maximize success, follow these general guidelines:

- Prioritize automation: Upgrade manual invoicing and follow-up efforts with software automation to avoid human errors undermining your procedures and evidence;

- Improve internally: Correct all flawed business practices and processes before instigating any punitive measures and contacting problem customers directly;

- Document everything: A thorough paper trail that includes phone calls will help you confront clients about missed payments;

- Be polite yet persistent: When contacting customers via emails or phone calls, skip harsh, accusatory messages. Uncover and accommodate patrons’ unique circumstances instead.

Schedule a consultation to learn more.

Table of Contents

Table of Contents