Updated by 09.10.2024

ACH Debit vs ACH Credit: What’s the Difference & Which One Is Right for You?

Automated Clearing House (ACH) payments are so reliable and secure that 78% of organizations utilize them to streamline payment processing. Typically, ACH payment solutions are used for recurring payments like salaries, subscriptions, and bill payments.

Understanding the distinction between an ACH credit vs ACH debit is crucial for business owners and organizations as it helps them optimize their payment processes and ensure smooth customer transactions.

This guide breaks down the key differences to help you choose the proper ACH method for your business. From streamlining payroll to simplifying invoicing, knowing what ACH debits and credits are will give you the upper hand in managing your business finances.

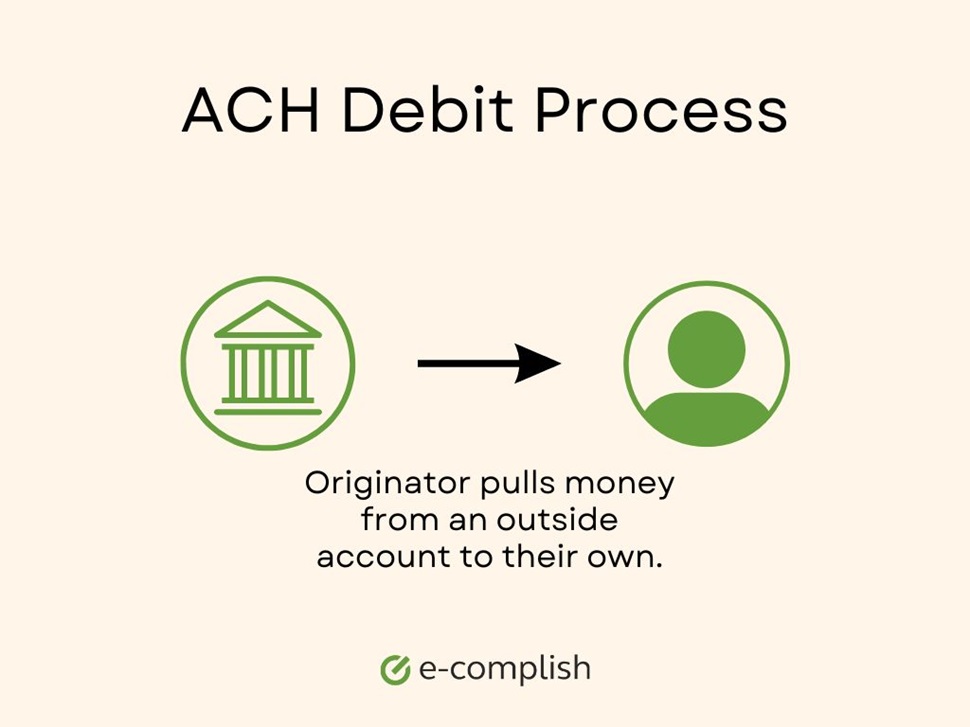

What Is ACH Debit?

ACH stands for Automated Clearing House – a network that connects banks and financial institutions so they can transfer payments. An ACH debit, or a pull payment, acts like a digital debit card.

It initiates a transaction by withdrawing funds from the payer’s bank account. The payer authorizes the pull by granting a business or individual permission to debit their account for the specified amount.

Once authorized, the ACH network securely transfers the funds to the recipient’s bank account, completing the electronic payment. This process bypasses the associated fees with traditional credit and debit card networks.

Benefits of ACH Debit

ACH debit payments offer three major advantages:

- Cost-effective: Lower processing fees compared to credit card transactions translate to significant savings for businesses (who pay less per transaction) and consumers (who might benefit from lower prices or subscription fees).

- Convenience: Businesses can schedule automatic withdrawals for subscriptions, memberships, or utility bills, ensuring on-time payments occur without manual processing.

- Control over payment collection: ACH debits guarantee funds are pulled directly from the payer’s account, eliminating the risk of bounced checks and late payments.

In the real world, ACH debits power a variety of applications:

- Automated bill payments: Monthly gym memberships, music streaming subscriptions, and utility bills.

- Streamlined loan repayments: Many lenders leverage ACH debits to automate monthly loan payments, ensuring timely payments and avoiding late fees for borrowers.

- Simplified B2B transactions: Efficient vendor payments or recurring service fees, simplify financial processes, and guarantee timely business transactions.

ACH Debit Standard Entry Class (SEC) Codes

A further layer of categorization exists within the ACH system – Standard Entry Class (SEC) codes. These three-letter codes provide specific details about the nature of the ACH debit transaction.

Some examples:

- ARC (Account Receivable Conversion): Signifies the electronic conversion of outstanding invoices or bills into a single ACH debit payment.

- BOC (Back-Office Conversion): Indicates an ACH debit initiated through a company’s internal accounting system, often for non-consumer transactions like vendor payments or payroll advances.

- POP (Point-of-Purchase): Identifies an ACH debit initiated at the point of sale, typically for debit card transactions or using a debit network at a physical location.

| SEC Code | ACH Debit Name |

|---|---|

| ARC | Accounts Receivable Conversion |

| BOC | Back Office Conversion |

| CCD | Cash Concentration or Disbursement |

| CTX | Corporate Trade Exchange |

| IAT | International ACH Transaction |

| MTE | Machine Transfer Entry |

| POP | Point of Purchase |

| RCK | Re-presented Check Entry |

| TEL | Telephone-Initiated Entry |

| WEB | Internet-Initiated Entry |

| PPD | Prearranged Payment and Deposits (Debit) |

By understanding these and other SEC codes, businesses ensure proper categorization for accounting and regulatory purposes.

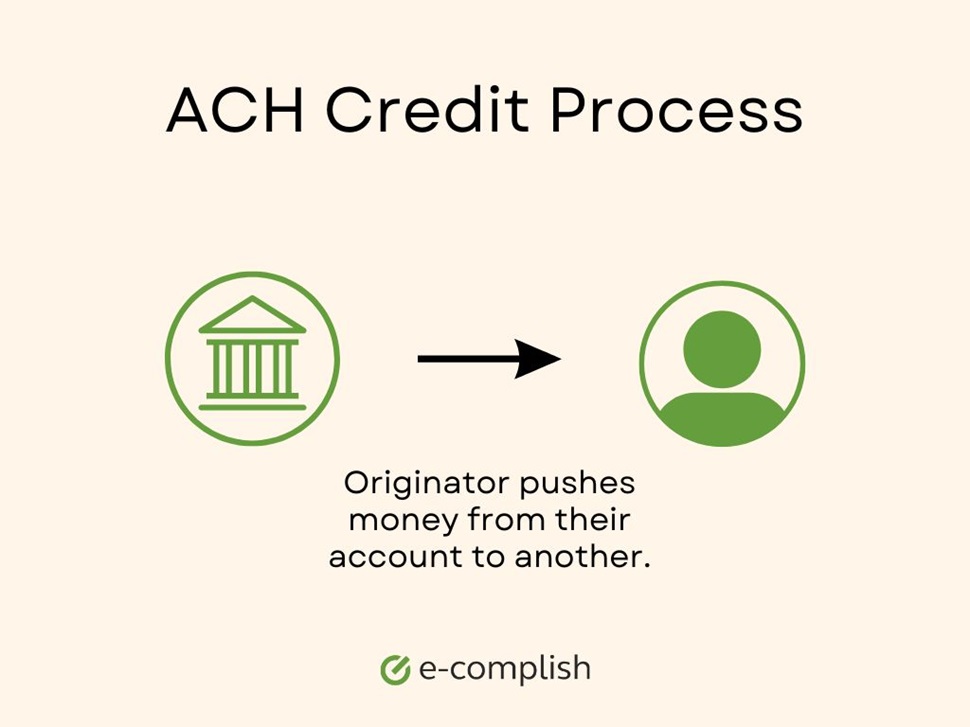

What Is ACH Credit?

An ACH credit, also known as a push payment, acts like a digital direct deposit. It initiates a transaction by electronically depositing funds into the receiver’s bank account. The originator (payer), typically a business or individual, initiates the ACH credit by providing the recipient’s bank account information and the amount to be transferred.

Once authorized, the ACH network securely transfers the funds from the originator’s bank account to the receiver’s, completing the electronic payment process. Unlike ACH debits that pull from the payer’s account, ACH credit “pushes” funds directly into the receiver’s account.

Benefits of ACH Credit

ACH credit payments offer four main benefits:

- Streamlined payroll processing: Conveniently pay employees’ salaries and wages.

- Efficient government benefits disbursement: Social security and unemployment compensation are delivered directly to recipients’ bank accounts.

- Faster tax refunds: Taxpayers can opt for direct deposit tax refunds to reduce waiting time.

- Simplified vendor payments: Automating payments to vendors for goods or services eliminates the need for manual check processing.

ACH Credit Standard Entry Class (SEC) Codes

While less diverse than ACH debits, ACH credits also have specific Standard Entry Class (SEC) codes to categorize the transaction type. Knowing these codes ensures proper processing and record-keeping.

Some examples:

- PPD (Prearranged Payment and Deposit): Used for recurring or pre-authorized credits such as payroll deposits, pensions, bills, or subscriptions.

- RCK (Re-Presented Check Entries): Electronic version of a previously issued paper check for payments that were returned physically and re-attempted electronically.

- WEB (WEB Initiated/Mobile Entries): ACH credit is initiated through an online or mobile app, commonly used for person-to-person payments, online bills, or recurring subscription payments.

| SEC Code | ACH Credit Name |

|---|---|

| POS | Point of Sale |

| PPD | Prearranged Payment and Deposits |

| RCK | Represented Check Entry |

| SHR | Shared Network Transaction |

| TEL | Telephone Initiated Entry |

| TRC/TRX | Check Truncation |

| WEB | Internet Initiated Entry |

| CCD | Cash Concentration or Disbursement (Credit) |

Familiarizing yourself with these and other SEC codes ensures accurate categorization of ACH credit transactions for accounting purposes, regulatory compliance, and smooth financial operations.

ACH Debit vs ACH Credit: Key Differences

What is the difference between ACH debit and credit? The following table provides a clear comparison of ACH debits and credits across several key features:

| Feature | ACH Debit | ACH Credit |

|---|---|---|

| Direction of Money Flow | Pulls funds from the payer’s account | Pushes funds into the payee’s account |

| Initiator of the Transaction | Receiver (payee) | Sender (payer) |

| Processing Time | Typically 1-3 business days | Typically 1-3 business days |

| Cost | Generally lower than credit card transactions | Generally lower than credit card transactions |

| Ideal Use Cases | – Recurring bill payments – Loan repayments – Direct debit authorizations |

– Payroll deposits – Vendor payments – Government benefits disbursement – Tax refunds |

Think of it like this: Who starts the ball rolling (initiates the transaction), where’s the money going (direction of the money flow), and what are you trying to achieve (ideal use cases)? Answering these questions will help you pick the best option for making ACH transactions.

Choosing the Right ACH Method for Your Business

Now that you know the difference between ACH debit and ACH credit, you’re probably wondering which is best for your business.

Recurring Billing

Imagine the ease of setting up automatic withdrawals for your customers’ subscriptions. No more chasing down invoices or late payments – ACH debits ensure a steady, automated flow of revenue into your business, freeing you to focus on other areas. Plus, your customers benefit from the convenience of automatic billing, never worrying about missed payments or late fees.

Payroll and Disbursements

Now, let’s flip the script. Let’s assume you’re disbursing funds for payroll, vendor payments, or even customer refunds. ACH credit now takes center stage electronically, pushing funds directly into the designated recipient’s bank account.

For payroll, ACH credits ensure timely and secure deposits for your employees. Vendor payments become effortless, eliminating the need for physical checks and streamlining your financial processes.

Even handling customer refunds becomes super simple, allowing for quick and efficient resolution. The popularity of ACH payments isn’t just a fad – it’s a powerful financial management tool waiting to be unlocked.

Benefits of Using E-Complish for ACH Payment Processing

As a leading provider of secure and reliable payment processing solutions, E-complish can help you reap the benefits of ACH payments. We’ve processed over $2 trillion for many businesses and organizations over the past 25 years and can do the same for you.

Moreover, our ACH debits and credits system offers seamless integration with your existing systems, PCI-compliant security measures to protect sensitive data, and exceptional customer service to ensure a smooth transition and ongoing success.

Want to experience the benefits of ACH payments? Try our demo.

Find the Right ACH Payment Method for Your Business with E-Complish!

Our experts understand the nuances of both methods and can guide you toward the most efficient ACH solution for your business. Are you eager to expedite the collection and clearance of over 5000 monthly single and recurring customer transfers? Then, adopt E-Complish’s ACH Processor today. It’s an environmentally friendly and efficient replacement for mail, phone, and email transactions.

Get in touch to chat with one of our experts now.

Table of Contents

Table of Contents